Balance Sheet: Key Components, Classification and Tips

- Published: 15 January 2025

- 10 min read

- Running a Business

Heather Cameron

Author

From expert guidance and helpful accounting tips to insights on the latest trends in fintech, Heather is here to empower entrepreneurs and small business owners in Singapore with great content. With a background in digital marketing spanning eight years, she has experience writing for various industries and audiences. As Osome’s copywriter, she’s here to inform and inspire our readers with great storytelling.

John Yap

Reviewer

John Yap, our Head of the Accounting Team in Singapore, brings over a decade of expertise in SFRS, corporate tax, and GST compliance. As a key blog reviewer, John ensures our accounting content is accurate and relevant, transforming complex concepts into actionable advice. With John's meticulous oversight, you can trust that our blog provides reliable and up-to-date information to help you navigate the intricacies of financial management and compliance in Singapore.

A balance sheet shows a company’s assets, liabilities, and shareholders’ equity, providing a snapshot of its finances. It’s a crucial tool for making informed decisions about investments, loans, and business strategies. This article will explain its key components and how to read it effectively.

Key Takeaways

- A balance sheet provides a snapshot of a company’s financial position by listing its total assets, liabilities, and shareholders’ equity, which is essential for evaluating financial health.

- The fundamental equation of a balance sheet, Assets = Liabilities + Shareholders’ Equity, ensures all financial data is accounted for accurately, reflecting the company’s financial strength and vulnerabilities.

- Analysing key metrics such as the current ratio and debt-to-equity ratio allows stakeholders to assess a company’s liquidity and financial leverage, which is crucial for informed decision-making.

What Is a Balance Sheet

A balance sheet communicates a company’s balance sheet worth by listing its assets, liabilities, and owner’s equity, providing a snapshot of its overall financial performance at a specific time. It summarises what a company owns and owes, offering a detailed overview of its financial stability and operational efficiency.

Our expert accounting services ensure your balance sheets are accurate, comprehensive, and compliant, saving you time and hassle. Focus on your business while we handle the numbers, empowering you with reliable insights to drive success.

The Balance Sheet Equation

The fundamental balance sheet formula is:

Assets = Liabilities + Shareholder’s Equity.This equation ensures either liabilities or shareholders’ equity funds every dollar in assets. It reflects the dual nature of a company’s financial structure – what it owes versus what it owns.

Maintaining balance is critical. If the equation does not hold true, it may indicate errors in data entry or miscalculations. Each side must be equal to the other for accurate financial reporting and analysis.

This balance not only reflects a company’s financial health but also its ability to meet future obligations and sustain growth.

Key Components of a Balance Sheet

Balance sheets consist of three main sections: Assets, Liabilities, and Shareholders’ Equity. Total assets include everything owned, from cash, balance received by company accounts receivable, and inventory to property and equipment. Liabilities detail what the company owes, such as loans and accounts payable.

Shareholders’ Equity represents the owners’ claims after settling all liabilities. Analysing these components helps stakeholders gauge the company’s financial health and operational efficiency.

Below are the basic balance sheet accounts to be calculated and documented:

Component | Description | Examples | Significance |

|---|---|---|---|

| Assets | What a company owns, divided into short-term (current) and long-term assets (non-current). | Cash, inventory, fixed assets, patents. | Reflects liquidity and long-term growth potential. |

| Liabilities | What a company owes, categorised as current (due within 12 months) or long-term (non-current liabilities). | Loans, pension fund liability, interest payable. | Highlights obligations and overall financial standing. |

| Shareholders’ Equity | Residual value of assets after liabilities. | Common stock, retained earnings. | Shows financial stability and the company’s long-term health. |

Assets

Assets, categorised by liquidity and duration, are the backbone of a company’s balance sheet. Current assets, expected to be converted into cash within a year, include cash, accounts receivable, rent received by property the company manages, inventory, and short-term deposits. These are crucial for day-to-day operations and offer a snapshot of the company’s current assets liquidity.

Long-term assets, or non-current assets offer economic benefits beyond one year and include property, plant, and equipment (PP&E), fixed assets, and intangible assets like patents. Long and short-term assets together account for your total assets.

Liabilities

Liabilities represent a company's financial obligations to outside parties and are categorised into current and long-term liabilities. Current liabilities, due within the next 12 months, include accounts payable, loan payments, and payroll liabilities. Examples are credit card bills and sales taxes collected.

Long-term liabilities, or non-current liabilities, are due after more than a year. They often include mortgage loans and bank debts. These obligations are settled either by cash payment or equivalent services, borrowing money impacting the company’s overall financial insight.

Accurate classification of liabilities is essential for proper financial reporting and analysis.

Shareholders' Equity

Shareholders’ equity equals assets minus liabilities. Positive equity indicates the company has sufficient assets to cover its liabilities, reflecting financial stability.

Retained earnings reflect the portion of net income reinvested in the business or used to pay off debt, which plays a crucial role in this section. Overall equity is calculated by adding net income, retained earnings, owner contributions, and shares of stock issued.

Understanding shareholders’ equity gauges the company’s long-term financial health and operational success.

How To Read a Balance Sheet

Reading a balance sheet involves understanding and interpreting key metrics and ratios. Metrics like liquidity, profitability, and debt-to-equity ratio offer insights into a company’s financial stability and performance potential.

Comparing balance sheets with others in the same industry is also important as different industries have unique financing approaches. This allows stakeholders to evaluate a company’s capital structure, liquidity, efficiency, and solvency. This understanding is crucial for making informed financial decisions in applications like financial modelling and investment analysis.

Current ratio

The current ratio measures a company’s ability to pay its current liabilities with its current assets. To calculate this, divide total current assets by total current liabilities. A higher current ratio indicates a lower risk of running out of cash, crucial for daily operations.

Example

Take a look at the following balance sheet example. ABC Co. calculated a current ratio of 1.71, suggesting healthy liquidity. Based on this number, the company decides if it can take on any long-term debt to boost growth in the next stage.

Debt-to-equity ratio

The debt-to-equity ratio compares a company’s total liabilities to its total equity to reflect how much financial risk may be present in the future. It is calculated by dividing total liabilities (the total amount a company pays) by total shareholders’ equity.

Example

Using the same example, ABC Co. had $200,000 of current liabilities and a debt-to-equity ratio of 2 in Year 1. This indicates a potential issue with the company's health since this number ideally should remain below 2. The stakeholders then consider ways to clear short-term obligations, such as consolidation and selling liquid assets. They may also hold back on shouldering any more long-term debt until revenue increases.

Practical Applications of the Balance Sheet

Balance sheets are one of the three core financial statements and can be used for various purposes. For financial modelling, historical data from balance sheets showing net asset developments can create forecasts, whereas metrics like revenue growth and capital expenditures can advise whether the company can handle more long-term debt liabilities for investment purposes.

Investors analyse financial ratios derived from the balance sheet to gauge performance and make investment decisions. Comparing balance sheets over time allows investors to assess financial stability, current assets, and liabilities.

Financial modeling

In financial modelling, balance sheets are invaluable for analysing a company’s financial status, calculating ratios, and assessing performance, liquidity, solvency, and efficiency. They provide detailed information about a company’s current assets and liabilities at a specific point in time, crucial for accurate financial forecasting.

Evaluating a balance sheet helps investors understand a company’s asset management and overall valuation, enabling more informed decisions. This application is essential for creating robust financial models that predict future financial performance and guide strategic planning.

When building financial models, integrate trends from previous balance sheets to identify patterns in asset growth, debt management, or equity changes. Combining this historical insight with real-time data enhances forecasting accuracy and highlights opportunities for strategic adjustments.

Investment analysis

For investors and stakeholders, balance sheets are essential for assessing returns and evaluating a business’s capital structure. Analysing the balance sheet helps gauge a company’s finances, operational efficiency, and performance potential.

The debt-to-equity ratio tends to be higher in industries requiring high technical investment relative to salaries. Companies often provide balance sheets to lenders to secure business loans, underscoring the document’s importance in financial decision-making.

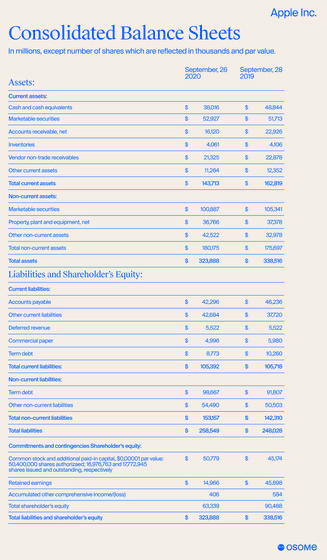

Example of a Balance Sheet

A good balance sheet example is Apple’s September 2020 sheet. It includes the total assets, current liabilities, and owner's equity. The company’s total assets reported were $323.8 billion, showcasing substantial financial strength.

The equity value comprises common stock value, retained earnings, and accumulated other comprehensive income, reflecting the residual interest in the assets. Despite the increase in total liabilities over the year, Apple’s detailed balance sheet helps stakeholders understand financial obligations and equity structure.

Common Mistakes To Avoid

Regular reviews and reconciliations ensure accuracy and reliability per generally accepted accounting principles. Failing to reconcile the balance sheet with the general ledger results in discrepancies in financial reporting.

Another common mistake is incorrectly classifying assets and liabilities, such as miscategorising fixed assets in the current portion or adding long-term loans into current liabilities. Overlooking off-balance-sheet items can also lead to an incomplete assessment of financial obligations and risks. Regularly updating and reviewing the balance sheet avoids outdated and misrepresenting information.

Importance of the Balance Sheet in Financial Statements

The balance sheet is one of the three primary financial statements used for business evaluation. Analysts often use it alongside other financial statements, such as income and cash flow statements, for thorough fundamental analysis.

Understanding the balance sheet’s relationship with other financial statements is crucial. It provides insights into a company’s financial performance and is vital for stakeholders and regulators to evaluate operational success and strategic direction.

Limitations of the Balance Sheet

While balance sheets are invaluable, they have inherent limitations. Assets are recorded at historical cost, which may not reflect current market values, potentially leading to understated or overstated asset values. Goodwill and other intangible assets may also appear at arbitrary values, lacking a direct correlation to market worth.

Non-monetary assets, such as employee skills and loyalty, are not represented on the balance sheet. The use of estimates for some current assets can also impact accuracy. These limitations underscore the importance of considering the broader financial context when analysing a balance sheet.

Summary

In summary, mastering the balance sheet involves understanding its components, the fundamental accounting equation, and the practical applications of these financial statements. Despite its limitations, the balance sheet remains crucial for assessing a company’s overall finances and making informed decisions. Businesses can ensure accurate and reliable financial reporting by avoiding common mistakes and regularly reviewing financial statements.