The Benefits of LLC vs Sole Proprietorship in Singapore

- Published: 16 January 2024

- 7 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Taking the leap into entrepreneurship in Singapore? One of the first crossroads you’ll encounter is the choice of your business structure. This decision can be pivotal, shaping the trajectory of your company. But how do you choose between a Limited Liability Company (LLC) and a Sole Proprietorship? Understanding the benefits of an LLC and a sole proprietorship can help you make an informed decision.

Key Takeaways

- Comparing LLCs and sole proprietorships comes down to the differences in taxation, legal protection, ease of formation and management, business credibility growth potential and financing options.

- An LLC offers personal asset protection from company debts and more expansive financing options than a sole proprietorship.

- Consulting with a business attorney or tax advisor is essential for choosing the most suitable structure for one’s business needs.

What Is a Sole Proprietorship?

Think of a Sole Proprietorship as a solitary ship sailing in the vast ocean of commerce. You, the small business owner, are the captain with complete control over the direction of your venture. A sole proprietor is an unincorporated business owned and run by one individual without distinction between the business and the owner.

However, this unincorporated business structure means you are liable for all the business debts, which are your personal income. Thus, the financial boundaries between you and your business blur, intertwining your business finances with your personal assets. Considering incorporation services can provide you with the necessary legal protections and financial advantages to navigate the complexities of business ownership.

Sole proprietorship advantages

Setting sail on the entrepreneurial ocean as a sole proprietor has its advantages. The simplicity of this business entity is akin to a small sailboat - easy to manoeuvre with minimal complications. There’s no need to grapple with extensive paperwork or filing fees, making it a cost-effective choice for a small business.

Being a sole proprietor also means that you have complete decision-making authority. Picture yourself as the captain of your ship with no one else on board to overrule your decisions. This autonomy extends to all facets of the enterprise, from operational decisions to management of business profits.

Sole proprietorship disadvantages

However, there are risks associated with a sole proprietorship vs other business structures such as a private limited company or LLC. As the sole proprietor, you shoulder all business obligations and debts. Just as a storm can capsize a lone ship, a financial downturn can mean your personal assets are at stake to cover business commitments and debts.

Moreover, the growth potential of being a sole proprietor can be limited, much like the capacity of a small sailboat. Without the ability to attract external investors, the growth of your enterprise is limited to your personal investments and finances. This can make securing funding challenging, just like sailing against the wind.

What Is an LLC?

In contrast, forming an LLC is like upgrading to a sturdier ship. This business entity is legally separate, providing a shield, or limited liability protection, between your personal assets and company debts. Additionally, you can still form a single-member LLC as it comes with all the benefits of a multi-member LLC structure.

An LLC offers a more formal business structure, with an operating agreement detailing the company’s governance and management. An LLC operating agreement is typically drawn up to document the members' and managers' rights and duties when there is more than one founder or member.

LLC advantages

An LLC provides a sturdy hull in the form of personal asset protection. Even in stormy financial seas, your personal assets remain safe from creditors. This business entity structure also offers the flexibility of a sailboat with the strength of a ship.

An LLC also has the advantage of boosting your business’s reputation. Just as a ship commands more respect than a sailboat, an LLC can increase business credibility, making it more attractive to investors, customers, and partners.

LLC disadvantages

But maintaining a ship isn’t cheap. The formation and maintenance of an LLC, especially if a single-member LLC, come with higher costs, including annual state filing fees and potential business licenses. These ongoing expenses can be complex and may require assistance to avoid penalties. Luckily, providers like Osome can provide professional guidance as a team of experts well-versed in what running a business in Singapore entails.

However, establishing an LLC involves handling more paperwork. The process includes selecting a business name, filing the necessary documentation, and adhering to the state’s specific requirements.

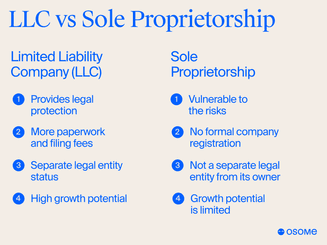

Limited Liability Company vs Sole Proprietorship

Comparing sole proprietorship vs LLC structures comes down to their differences in terms of:

- Taxation

- Legal protection

- Ease of formation and management

- Business credibility

- Financing options

Taxation comparison

Regarding taxation, LLCs and sole proprietors operate on a pass-through taxation model, which means they pay taxes through the owners’ personal tax returns. However, when deciding between an LLC, single-member LLC, or sole proprietorship, LLCs gain an edge with their ability to select the most favourable tax structure, potentially leading to tax savings.

By default, all profits made by an LLC are only taxed once. As the LLC owner, the tax liability belongs to you and passes through to your personal tax return.

The Qualified Business Income deduction is among the most noteworthy tax benefits for LLCs and sole proprietorships. This allows a deduction of up to 20% of qualified business income, potentially lowering the tax burden on business expenses and self-employment tax. However, not all small businesses are eligible, so consulting a tax professional is advisable.

If your business thrives and consistently grows its revenue, an LLC might be the way to go instead of SP. For instance, an individual earning S$100,000 would typically be subject to progressive personal income tax rates ranging from 0% to 22%. In addition to this, there may be contributions to the Central Provident Fund (CPF) as part of the overall tax structure.

Comparatively, if you operate as an LLC, the corporate income tax rate in Singapore is 17%. This can represent a significant difference in cost when compared to the individual income tax rates and mandatory contributions applicable to sole proprietors or self-employed individuals. Considering these factors in the Singaporean context is essential when deciding on the most tax-efficient structure for your growing business.

Legal protection

In the turbulent seas of business, an LLC provides a sturdy lifeboat in the form of personal liability protection. This structure shields the owners from personal liability for the company’s debts. Just as a ship’s hull prevents water from spilling into the ship, an LLC separates the business owner’s personal finances from the business’s debts.

Conversely, a sole proprietor can be compared to a swimmer in the open sea, vulnerable to business risks. Any business debts or obligations become personal liabilities, potentially leading to a financial whirlpool that could pull in personal investments to cover business debts.

Ease of formation and management

Regarding ease of formation and management, an SP structure is a simpler vessel to navigate when choosing between the two types of business entities. This structure requires no formal company registration, making it a cost-effective and straightforward choice for small businesses.

However, forming an LLC, while requiring more paperwork and filing fees, provides a more structured framework for managing your business, even if it's a single-member LLC. It’s akin to upgrading to a ship with a dedicated crew, each member fulfilling specific roles in the smooth sailing of the enterprise.

Note that only local citizens are eligible to register a sole proprietorship.

Business credibility and growth potential

In terms of business credibility and growth potential, an LLC offers several advantages:

- Separate legal entity status

- Liability protection

- Attracts attention and respect

- More appealing to investors and customers

These benefits enhance business credibility and make an LLC a great choice for many entrepreneurs looking to establish business credit.

On the other hand, a sole proprietorship, similar to a small sailboat, may not command the same level of respect as it is an unincorporated business. The growth potential of a sole proprietorship is confined to the owner’s resources, potentially limiting its ability to expand and attract investors.

Financing options

Navigating the seas of financing options, an LLC sails ahead. Its structure and credibility open up a wider array of financing options, including access to venture capital.

In contrast, a sole proprietor's business may have a tougher time securing business credit. Given its lack of legal protection, lenders may be hesitant to extend credit to a business that doesn’t separate personal and business assets compared to limited liability companies.

Switching Between Business Structures

In the dynamic business world, the ability to switch between business structures provides versatility. Converting from a sole proprietorship to an LLC is a relatively straightforward process, akin to upgrading from a sailboat to a ship. The transition involves fulfilling state and tax documentation requirements and paying applicable fees.

However, downgrading from an LLC to a sole proprietorship is more complex, like trying to convert a ship into a sailboat. This process might require dissolving the LLC and dealing with the subsequent tax implications and potential legal issues.

What Are the Next Steps?

After these two business structures, the next step is to guide your business in the right direction. Consulting with a business consultant and tax advisor will help you navigate through the complexities of business structures and chart the best course for your entrepreneurial journey.

Summary

To wrap up, LLCs and sole proprietorships offer unique advantages and drawbacks, like comparing a sailboat to a ship. Whether you’re drawn to the simplicity and control of a sole proprietorship or the legal protection and credibility of an LLC, the choice depends on your individual business needs and goals. Remember, the right business structure is the compass that guides your entrepreneurial journey, paving the way for smooth sailing or weathering the storm.

FAQ

Why is an LLC company structure better than a Sole Proprietorship?

Incorporating your business provides greater protection and responsibility for your directors and shareholders, effectively limiting the owners' personal liability.

What is the disadvantage of a Sole Proprietorship?

A disadvantage of Sole Proprietorships is that you have unlimited liability for debts, limited capacity to raise capital, full responsibility for making business decisions, and difficulty retaining quality employees.

What is a Sole Proprietorship?

A Sole Proprietorship is a type of business structure that allows an individual to have complete control and is personally liable for debts and taxes, with minimal setup requirements or costs.

What is an LLC?

An LLC is a legal business structure offering liability protection with expedient setup and cost-efficiency, making it highly sought after.

What are the benefits of an LLC?

Forming an LLC provides significant benefits, including personal asset protection, tax flexibility, and increased business credibility.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?