Limited Liability Partnerships (LLP) in Singapore

- Published: 5 March 2024

- 7 min read

- Starting a Company

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

What defines a Limited Liability Partnership (LLP) in Singapore, and why might it be the right choice for your business? An LLP in Singapore is a hybrid legal structure that shields your personal assets while offering the flexibility of partnership business operations. This introductory guide will take you through the core features, advantages, disadvantages, and essential compliance requirements of using an LLP for your venture in Singapore.

Key Takeaways

- A Limited Liability Partnership (LLP) in Singapore is a separate legal entity that offers partners limited liability protection, combining the benefits of a partnership with some features of a corporation.

- The structure of an LLP in Singapore requires at least two partners, who can be individuals or corporate entities, and one manager responsible for the compliance, with partners’ liability limited to their contributions to the LLP.

- The registration for an LLP in Singapore is governed by the Limited Liability Partnerships Act 2005. It involves reserving a unique name and registering the entity with ACRA, with annual filing requirements to maintain legal and financial compliance.

What Is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership (LLP) represents a unique business structure, merging the perks of partnerships and companies. In Singapore, an LLP is acknowledged as a separate legal entity, independent of its partners, and can be considered a corporate entity. This grants the LLP its own set of rights and obligations. This allows it to own property, possess a common seal, and execute legal actions like a corporation can. However, there’s a twist: partners in an LLP benefit from limited liability protection, safeguarding their personal assets from the LLP’s liabilities and obligations.

For those interested in setting up an LLP, we offer expert company incorporation services to streamline the process and ensure full compliance with Singapore’s regulatory requirements.

Features of a Limited Liability Partnership

An LLP in Singapore is more than a business structure; it offers a unique blend of benefits and duties that provide a strong foundation for businesses to thrive. Let’s break down these features:

Partners' liability

In an LLP, a partner's liability is limited to the amount of their contributions. This helps to protect the partner's personal assets from being used to pay off the debts of the LLP. This means that as a partner in an LLP, you will only be held personally liable for any debts if you or other partners have directly caused losses or debts through your own negligence or inaction. Moreover, the limited liability partnership structure shields individual partners from personal liability arising from the negligent acts of other partners.

This feature of limited personal liability distinguishes LLPs from conventional partnership structures and, unlike private limited companies, makes a limited liability partnership agreement an essential component of an effective partnership structure.

LLP structure and management

A Singapore LLP requires:

- At least two partners, with no cap on the maximum number

- These partners can be individuals or corporate entities

- The mutual rights and duties of the LLP and its partners are determined by a partnership agreement, a crucial document that governs internal relations.

Moreover, there should be a minimum of one manager in every LLP who oversees compliance. This manager must be a Singapore resident, at least 18 years old, and not convicted of any fraud or dishonesty-related offences.

Company name and business address

During the company registration process, an LLP in Singapore must have a distinct name and a registered office address located within the nation. The proposed company name should not be identical to any existing business name registered with ACRA (Accounting and Corporate Regulatory Authority) or a previously reserved name.

It should also be acceptable to public policy and not offensive to any segment of the community or any friendly state or religion in Singapore.

The legal framework of an LLP

The Limited Liability Partnerships Act 2005 regulates the establishment, functioning, and termination of LLPs in Singapore. This legal framework outlines the rights and obligations of partners, as well as the administration and dissolution procedures of LLPs.

The Act also stipulates that LLPs must appoint at least one manager who is ordinarily resident in Singapore.

Advantages and Disadvantages of LLPs in Singapore

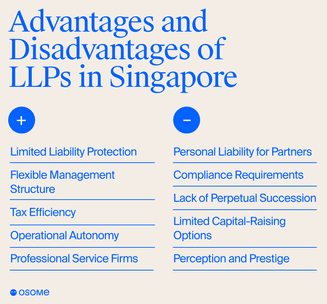

Like all business structures, LLPs in Singapore possess their own pros and cons. On the plus side, an LLP has:

- a separate legal identity, which allows it to own property, enter into contracts, and sue (or be sued) in its own name

- partners who are not held personally liable for the LLP’s business debts or for the wrongful acts of other partners, protecting their personal assets

- perpetual succession, meaning the partnership remains unaffected by changes such as the resignation or death of partners.

Furthermore, compliance requirements for a Singapore limited liability partnership are less stringent, unlike private limited companies', though more complex than for a sole proprietorship.

A limited liability corporation in Singapore is a popular business framework due to its flexibility and tax benefits. However, there are also some important drawbacks to consider before choosing this structure.

One major concern is the potential personal liability that partners may face in the event of negligence or misconduct. Additionally, there may be compliance complexities to navigate, perpetual succession is not guaranteed, and there may be limited options for capital-raising.

Furthermore, there is a perception that a limited liability company carries less prestige than a private limited corporation. Therefore, it is important for partners to carefully weigh these disadvantages against their business needs before deciding on an LLP structure.

Documents Needed To Register an LLP in Singapore

The process of registering an LLP in Singapore requires particular documents and information for the purpose of legality and transparency. You’ll need to provide:

- The proposed LLP name

- Particulars of the LLP partners/managers as per the foreign passport or Singapore identity card

- The residential address of the LLP partners/managers

Furthermore, a declaration of compliance is necessary for the LLP registration process.

When the partner is a company, it is necessary to provide additional registration details, including the registration number, jurisdiction, and registered address.

Limited Liability Partnership Registration in Singapore

The Limited Liability Partnership Act of 2005 guides Singapore’s Accounting and Corporate Regulatory Authority (ACRA) in supervising the LLP's registration. The process itself is straightforward and involves two main steps: name reservation and registration of the entity.

Eligible partners forming an LLP can be individuals, local companies, foreign companies, another LLP, or existing partners.

Opening a Bank Account for an LLP in Singapore

Following the registration of the LLP, the subsequent step involves opening a bank account for it. A Singapore LLP can open a bank account with either a local, foreign, or international bank located in the country. This flexibility allows for various banking choices based on the LLP’s specific needs and preferences.

An LLP may choose to open multiple bank accounts in different currencies or opt for a single multi-currency bank account, depending on its business needs.

A professional services firm can assist with providing referrals to local bank partners — Osome is one of them! We have an established network of banking partners and will guide business owners in choosing the best one according to their needs.

Annual Filing Requirements

Singaporean LLPs need to comply with the government's annual filing requirements for regulatory compliance. These include:

- Maintaining financial records for 7 years

- Submitting an annual declaration of solvency or insolvency

- Updating any changes with the registrar within 14 days

Penalties may be imposed for late filings, and changing an LLP’s entity name incurs a fee.

Summary

From the definition to the features, advantages, and registration process of a Singapore LLP, we’ve covered quite a lot of ground. An LLP is an attractive corporate structure that combines a partnership's benefits with a corporation's legal protection. It offers limited liability, being a separate legal entity, flexibility, and ease of management. However, it also comes with its set of challenges, such as potential risks from partners binding the LLP to business agreements and restrictions on ownership transfer.

Get in touch with the onshore team of experts at Osome for guidance on choosing the best business structure for your needs and goals, as well as providing a company secretarial services and a suitable accounting plan.

FAQ

What is an LLP Singapore?

A Singapore LLP is a form of business entity that combines the flexibility of a partnership with the separate legal identity and limited liability features of a private limited company under the Singapore LLP Act 2005.

What is the difference between an LLP and a Ltd?

The key difference between an LLP and a Ltd lies in how they are taxed. In an LLP, members are treated as self-employed and pay income tax on their share of profits, while a limited company is considered a separate entity and is subject to corporation tax on its profits.

How does an LLP work?

A Singapore limited liability partnership, as with others in different countries, provides owners with the flexibility of a partnership and the separate legal personality of a private limited company, making it a distinct legal organisation from its partners.

What is the primary legislation that governs LLPs in Singapore?

The Limited Liability Partnership Act of 2005 is the primary legislation governing LLPs in Singapore and the LLP registration process.

What is the process of registering an LLP in Singapore?

To register an LLP in Singapore, you must complete two main steps: name reservation and entity registration with ACRA. This ensures that your LLP is legally recognised in Singapore.

Is an LLP a separate legal entity in Singapore?

No, a Singapore limited liability partnership (LLP) is not considered a legally separate entity in Singapore. Instead, it is a legal structure where partners have limited liability for any business debts incurred and other obligations. While the Singapore LLP itself can enter into contracts, sue, or be sued in its own name, it does not have the same legal identity as a private limited company. This means that partners in an LLP are personally liable for their own actions and liabilities, as well as for the actions of their fellow partners within the scope of the LLP's business.

More like this

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions,Privacy and Data Protection Policy

We’re using cookies! What does it mean?