How To Open a Bank Account in Singapore: A 2024 Guide

- Published: 6 February 2024

- 9 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Opening a bank account in Singapore? Discover the essential steps as our guide covers what residents and foreigners need to know – documents, requirements, and online procedures. Embark on your Singapore banking journey with clarity and confidence, avoiding unnecessary surprises along the way. Learn how to open a bank account in Singapore seamlessly and efficiently.

Key Takeaways

- To open a bank account in Singapore, individuals must meet specific criteria such as being at least 16 years of age and having necessary identification and proof of residence. Depending on the bank, they may be required to make an initial deposit.

- Foreigners can open bank accounts online in Singapore by selecting a suitable bank that meets their needs, preparing the necessary documents such as a valid passport or national ID, and completing the application process with accurate information.

- Singapore banks offer diverse banking features and services, including multi-currency accounts, savings options, mobile banking apps, and expatriate-specific services, each tailored to meet different customer needs and financial objectives.

Essential Criteria for Opening a Bank Account in Singapore

Although Singapore’s banking sector is widely recognised for its stability and diversity and is open to foreigners, specific criteria must be fulfilled, largely related to the applicant's personal details. The primary eligibility criterion is age. The minimum age for opening a Singapore bank account is 16 years old, and an initial deposit may be required depending on the bank’s policies.

For those involved in company incorporation, the documentation necessary to establish an account varies among banks. Typically, proof of identity, such as a passport, national ID card, and evidence of a residential address, is required. Tax residency proof for each country or jurisdiction may also be necessary. While each bank in Singapore may have unique requirements for opening personal accounts, a common stipulation across most institutions is the customer's physical presence in Singapore for account setup.

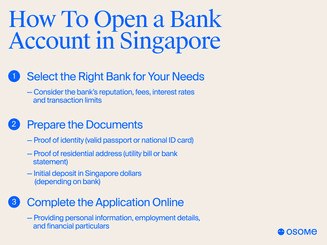

How To Open an Account Online: Step-by-Step Process

With the significant digitalisation of Singapore banking services, foreigners can now open an account online given they provide the documents required. We will explore this process in detail in the subsequent sections, which includechoosing an appropriate bank, preparing the required documents, and finalising the application process.

Selecting the Right Bank for Your Needs

Choosing a bank that aligns with your specific needs is the first step in the journey. The selection process should consider the bank’s:

- Reputation

- Fees

- Interest rates

- Transaction limits

- Additional benefits such as a free debit card

- Minimum deposit specifications

It’s also beneficial to consider recommendations from friends, family and existing customers when researching the bank’s business account offerings, minimum deposit and balance requirements, and associated fees. Considering perks such as zero monthly fees, free internet banking, and a comprehensive debit card is essential for you to be a happy and long-standing customer.

If you’re interested in multi-currency accounts, Singapore has some excellent options. These renowned banks allow you to hold and trade in several currencies:

- DBS

- UOB

- OCBC

- Standard Chartered

When considering banks that offer foreign currency deposits, exploring dual currency investments, structured deposits and supplementary retirement scheme options is essential. Make sure to check if the bank is a member of the Singapore Deposit Insurance Corporation to ensure the safety of your deposits.

Preparing your documents

Once you have chosen the appropriate bank, you should then assemble the required documents. This typically includes the following documents:

- Proof of identity, such as a passport or national identity card

- Proof of residential address in the form of a utility bill or bank statement

- Some banks may also require an initial deposit in Singapore dollars

- Proof of tax residency if you declare tax residency anywhere other than Singapore, if relevant

The documents required may vary depending on your status. For instance, long-term visitors must provide proof of employment/study, a valid long-term visit pass or dependent pass, a letter of employment or admission, and a passport. Similarly, employment pass holders must provide a passport and EP.

Completing the application online

The last phase involves completing the online application. This involves furnishing your personal information, employment details, and financial particulars. You can then proceed to upload the required documents and finalise the application by adhering to the instructions provided by the bank.

Before submitting your application, verifying the accuracy of all the information provided is crucial. Ensure that the uploaded documents are clear and valid. It is crucial to review the entire application for accuracy to prevent potential delays or rejections caused by errors. If you are having trouble, many banks give you the option for the service team to contact you on a preferred date for in-depth assistance.

Banking Features and Services To Consider

Upon opening your account, various banking features and services become available, such as a debit card and online banking. In the subsequent sections, we will discuss multi-currency accounts, foreign currency options, and wealth management services. These are key considerations that can significantly impact your banking experience in Singapore.

Multi-currency accounts and foreign currencies

Multi-currency accounts are a unique feature of Singapore banks, offering many advantages. These accounts allow individuals to:

- Consolidate funds in various foreign currencies in a single location

- Utilise the funds interchangeably as required

- Facilitate immediate transfers or payments overseas

- Provide more economical conversion and exchange fees.

Choosing a bank for a multi-currency account involves considering various options. Some notable banks with strong multi-currency account offerings are:

- DBS Multi-Currency Account

- UOB Global Currency Account

- OCBC Global Savings Account

- Standard Chartered

Whether you trade in Singapore dollars for your business or need to hold US Dollars for a specific transaction, there are multiple bank account options that allow you to do this.

Wealth management and savings options

Besides the basic banking services, Singapore banks offer an array of wealth management services, including:

- Cash and money markets

- Investment-grade bonds

- High yield bonds

- Equities

- Foreign exchange

- Derivatives

- Structured products

- Third-party mutual funds

Regarding savings options, several banks offer favourable rates and conditions. A few options include:

- The Savings Account by Trust, which offers a 3% interest rate

- The Standard Chartered e$aver Savings Account offers, which a 2% interest rate

- The UOB One Account, which offers a 5% interest rate

Opening Accounts for Different Customer Categories

The procedure for opening a bank account in Singapore varies according to the customer category. The upcoming sections will provide guidelines for the following:

- Students

- Long-term visitors

- Expats

- EP holders

Students and long-term visitors

Students and long-term visitors can open a bank account in Singapore. As a student, you must be at least 16 years old and provide proof of residential address from your home country and a copy of your employment or student pass.

For long-term visitors, the process involves providing proof of employment or study, a valid long-term or dependent pass, and a passport. Banks like DBS, UOB, and OCBC offer specialised services to cater to the specific needs of students and long-term visitors.

Expats and employment pass holders

Foreigners residing in Singapore on an employment pass or a student or long-term visit pass, including expats, can open a bank account in Singapore. To open an account, you will need a passport or identity card, proof of residential address, and a valid pass. In some cases, banks may require proof of tax residency if you declare tax residency in your home country and not in Singapore. The DBS Multiplier account is a popular choice among expats since it allows holding multiple currencies.

Additional requirements may include proof of company incorporation for business accounts and proof of residence for foreigners. Notably, DBS Bank, UOB, and OCBC are recognised for offering services tailored to the needs of expats and EP holders.

Can Foreigners Open Bank Account in Singapore?

Many foreigners ask, “Is it possible for me to open a bank account in Singapore?” The answer is absolutely! Singapore’s banking system welcomes foreigners, provided they meet the necessary requirements. This includes providing a passport, proof of address, an EP, student pass, or long-term visit pass for successful account opening. Additional documentation may be necessary, depending on the bank’s policies. Depending on the new account type, foreigners can track their application status without the need to visit the branch in person.

Prominent accounts such as DBS, UOB accounts, and OCBC are suitable for non-residents seeking to open bank accounts in Singapore. These banks offer customised services such as multi-currency accounts and remittance services, and they facilitate remote account opening through online platforms. However, in the case of a UOB account, it's likely you will be required to visit the branch in person.

Banking On-the-Go: Mobile and App Solutions

Like most modern banking systems, banks in Singapore provide comprehensive mobile banking and app solutions. You can use the app to pay bills, transfer money, and manage your account easily and while you're on the move.

Let’s delve into how this works after the account opening process has been completed.

Download the bank’s app via QR Code

Downloading the bank’s app is as simple as scanning a QR code with your smartphone. QR codes provide a convenient method for accessing the app’s download page directly in the app store, thereby streamlining the process for users.

Once you’ve downloaded the app, you’ll need to set up your account for mobile banking. This may involve enabling app features, such as QR code scanning for payments or accessing banking services directly through the app.

Digital tools to pay bills and transfer money

Once the account opening step has been completed, most Singapore banks offer an array of digital tools for managing transactions. These include e-wallets like Google Pay, FavePay, Singtel Dash, Grabpay, and bank-owned mobile wallets such as DBS PayLah and OCBC Pay Anyone. These tools facilitate easy bill payments, in-store QR transactions, and bank account fund transfers.

Several platforms are recommended for transferring funds in Singapore, including:

- MoneyGram

- Western Union

- SingX

- Remitly

- Instarem

- Wise

These applications are widely favoured for their effectiveness and user-friendly interfaces.

Navigating Regulatory Requirements

Awareness of local laws and regulations is critical when opening a bank account in Singapore. The Monetary Authority of Singapore (MAS) oversees all payment systems in the country and maintains legal distinctions between foreign and local banks.

The primary regulatory prerequisites outline the need for a passport for identity verification and proof of address. Moreover, additional requirements may encompass proof of company incorporation for business accounts and proof of residence for foreigners. It’s crucial to consult the Compliance Toolkit offered by MAS and adhere to the guidelines outlined in the MAS Notice 626 to ensure compliance.

Personalised Support from Service Teams

Rest assured, you are not alone when opening a bank account in Singapore. Banks provide both online support and require in-person presence for certain steps of the account opening process. This robust customer service ensures a smooth and efficient account opening experience.

Efficiency in customer service is a hallmark of Singaporean banks. DBS/POSB Bank, for instance, achieved the highest satisfaction score among banks according to the Singapore Customer Satisfaction Index. Most banks provide multiple contact channels for customer service, including hotlines and emails, ensuring that help is readily available when needed.<br>

Summary

In conclusion, opening a bank account in Singapore as a foreigner is feasible, provided you meet the essential criteria and understand the regulatory requirements. With a range of banking features and services, from multi-currency accounts to digital payment tools, Singapore banks are well-equipped to cater to diverse banking needs. Whether you’re a student, a long-term visitor, an expat, or an employment pass holder, the Singapore banking sector welcomes you with open arms. So, why wait? Start your Singapore banking journey today!

FAQ

Can a foreigner open a bank account in Singapore?

Yes, non-residents can open a bank account in Singapore by providing a passport, proof of address, and other required documentation based on the bank's policies.

What is the minimum amount needed to open a bank account in Singapore?

The minimum deposit needed to open a bank account in Singapore usually ranges from S$500.00 to S$5,000.00, depending on the bank and account type. Additionally, it's important to bear in mind potential transaction fees.

Can I open an online bank account in Singapore?

Yes, you can open an online bank account in Singapore with OCBC. OCBC is the first Singapore bank to offer a fully digital account opening service.

What digital tools are available for banking transactions in Singapore?

In Singapore, you can utilise digital tools like e-wallets (Google Pay, FavePay, Singtel Dash, Grabpay), bank-owned mobile wallets (DBS PayLah, OCBC Pay Anyone), PayNow QR, and dedicated bill payment services (POSB Bill Payment, UOB Bill Payment) to manage banking transactions efficiently.

What are the regulatory requirements for opening a bank account in Singapore?

To open a bank account in Singapore, you need a valid passport for identity verification, proof of address, proof of company incorporation for business accounts, and proof of residence for foreigners.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?