Top 10 Small Business Accounting Software Solutions for 2026

- Modified: 10 February 2026

- 16 min read

- Grow Your Business

Heather Cameron

Author

From expert guidance and helpful accounting tips to insights on the latest trends in fintech, Heather is here to empower entrepreneurs and small business owners in Singapore with great content. With a background in digital marketing spanning eight years, she has experience writing for various industries and audiences. As Osome’s copywriter, she’s here to inform and inspire our readers with great storytelling.

Kelly Yik

Reviewer

Kelly Yik, our Accounting Team Lead based in Singapore, ensures that the team meets quality standards and follows accounting standards (SFRS) while remaining compliant with all the authorities' rules and regulations in Singapore. With six years of experience in Singapore accounting, she knows the ins and outs of financial reporting standards, GST, and corporate tax like nobody's business. Kelly supports our blog writers by carefully reviewing our content, making sure it's accurate, up-to-date, and packed with helpful tips for Singapore businesses. So, you can trust the info you get on our blog is not only interesting but also reliable!

Choosing the right small business accounting software is crucial for effectively managing your finances. In this article, we review the top 10 accounting software solutions for 2026, focusing on their features, benefits, and how they can help your business thrive.

Key Takeaways

- Accounting software automates bookkeeping, reducing errors and saving time, allowing small business owners to focus on growth and customer service.

- When selecting online accounting software, look for features such as expense tracking, invoicing capabilities, inventory management, financial reporting, and compliance support to enhance financial clarity and efficiency.

- To choose the best accounting software for your business, you need to assess specific business needs and budget considerations and ensure scalability to support business growth.

Why Small Businesses Need Accounting Software

Managing finances manually can be tedious and error-prone for entrepreneurs. While free accounting software may serve the purpose during the dawn of your business, eventually, you may want to seriously look into professional accounting software for small businesses to access premium accounting features that will significantly streamline and enhance your money game.

For example, automated bookkeeping spares you from human errors while accelerating the process, allowing business owners to focus on growth and customer satisfaction. Automation of routine accounting tasks enhances accuracy, streamlines operations, and keeps financial records consistently up-to-date and reliable.

Also, accounting software makes business management much easier with real-time reports reflecting your latest financial transactions. These tools can generate various customised reports and track expenses across multiple accounts. Some also offer automatic tax calculations when creating invoices, ensuring you don't breach tax liabilities.

Osome offers seamless accounting services with expert support, automating your financial processes so you can focus on what truly matters. Let us handle your bookkeeping, tax filings, and reports with precision – giving you the confidence to grow your business.

Mobile apps and cloud-based small business accounting tools offer significant convenience. These features allow business owners to access accounting services from anywhere, making it easier to manage their operations on the go.

A cloud-based accounting tool also allows seamless financial data sharing with accountants or bookkeepers, fostering collaboration and efficiency. Third-party application integrations for sales and even inventory tracking can further enhance the functionality of these tools, making them indispensable for any business owner.

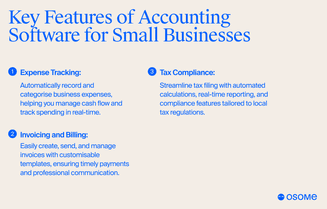

Key Features to Look for in Small Business Accounting Software

Business owners must carefully consider the following features before choosing accounting software: income and expense tracking, invoicing and billing, financial reporting, third-party integration, and tax compliances.

Maintaining financial clarity and managing cash flows effectively rely heavily on accurate expense tracking. The right accounting software should offer robust tools for recording, categorising, and tracking expenses, making it easier to generate accurate financial reports.

Invoicing and billing features streamline the billing process, helping businesses manage their cash flow and reduce the risk of late payments. Compliance, supported by features such as automated tax calculations and GST compliance, is crucial for efficient business operations.

Expense tracking

Accurate expense tracking is indispensable for any business as it helps manage cash flows and maintain financial health. Accounting software simplifies this process by offering features like receipt scanning, recurring payments, and bank account linking, which reduce manual data entry and the risk of errors. These tools allow users to record expenses, categorise them, and import transactions from bank accounts, providing a comprehensive overview of financial transactions.

Categorising transactions in accounting software enhances the accuracy of financial reports by providing clear insights into income and expenses. Some software even allows users to upload pictures of receipts, attach them to expense forms, and use OCR technology to extract data, making reporting more accurate and efficient.

Overall, accounting software streamlines the expense tracking process, helping business owners maintain better control over their finances.

Invoicing and billing

Efficient invoicing and billing are crucial for managing cash flow and ensuring timely payments. Accounting software simplifies this process by automating reminders and managing payment terms effectively. Features like creating templates, adding payment terms, setting reminders, and automating calculations improve the invoicing process, making it more streamlined and less prone to errors.

Online invoicing functionality, such as that offered by Osome, facilitates easy invoice generation and tracking. Tools like FreshBooks provide robust project and time-tracking capabilities, which are particularly beneficial for service-based businesses.

Integrating online payments with accounting software simplifies the payment process further by allowing settlements on a single portal, thus improving the overall efficiency of managing accounts receivable.

Third-party integration

Make sure your accounting app can communicate with your existing tools, including time-tracking apps, inventory management tools, payroll software, CRM, and your online banking tool. These integrations are crucial to ensure all your information is pulled into one central app, providing enhanced clarification and reducing risks of errors when tax season comes.

Tax compliance

Tax compliance is a critical aspect of business accounting that can be significantly simplified with the right software. Automated tax calculations help businesses adhere to local tax regulations, ensuring accurate and timely tax filings, and reducing the risk of errors or fines. Features like GST compliance, as provided by Osome, are essential for businesses to stay compliant with tax regulations and avoid legal penalties.

The ability to automate tax calculations and generate detailed reports on sales tax liabilities makes the accounting process more efficient and less stressful for business owners. This ensures that businesses can focus on their core operations without worrying about compliance.

Top 10 Accounting Software Solutions for Small Businesses

Finding the best accounting software can be daunting due to the myriad of available options. This review explores the top 10 small business accounting software solutions for 2026, focusing on their features and benefits. These software options have been chosen based on their user reviews, features, cost-effectiveness, and how well they cater to your needs.

From free accounting software like Wave to more comprehensive solutions like QuickBooks Online and Xero, each software has unique strengths that make it suitable for different business needs. Whether you’re looking for robust invoicing capabilities, multi-user access, or seamless integration with other business tools, this list covers a range of options to help you make an informed decision.

1 Osome

Osome stands out as an all-in-one accounting solution tailored for small businesses in Singapore and beyond. Beyond automated invoicing, expense tracking, and cash flow analysis, Osome combines smart software with real human expertise to make financial management easier. It handles statutory compliance, tax obligations, and filing deadlines so you can stay compliant without the stress of manual tracking.

Osome’s packages include full bookkeeping services, payroll support, and customised financial reports, providing a complete financial management solution that scales with your business. Whether you’re a startup founder, freelancer, or SME owner, Osome’s team helps you understand your numbers and make informed decisions.

Price:

- Operate – from S$ 75/m

- Grow – from S$ 99/m

- Scale – from S$ 227/m

Curious how Osome works in action? Watch our 2-minute demo video to see how automated bookkeeping, tax compliance, and financial insights come together in one intuitive platform — helping you run your business with confidence.

2 QuickBooks Online

QuickBooks Online is a popular choice among small business owners due to its comprehensive set of tools for effective financial management. Its user-friendly dashboard provides access to all accounting tools and a wide array of financial reporting tools. It also recognises multiple currencies while easily accepting payments from overseas banks and accounts.

With scalable options and strong support, QuickBooks Online is suitable for businesses of various sizes and offers unique features like integration with TurboTax and one-way video chat with a dedicated bookkeeper. It also has a bundle to pair payroll services with bookkeeping services to keep all your needs in one place.

Price: From around S$ 13–28 per month for basic plans, up to approximately S$ 56–109 per month for advanced tiers.

3 Xero

Xero is the most popular accounting software in Singapore, known for its user-friendly features and flexible pricing. It supports multi-user access, online invoicing, bank reconciliation, and receipt capture, making it ideal for businesses looking for a collaborative tool.

Xero also has powerful accounting automation capabilities, making it a top choice for small businesses, especially solopreneurs who don't have much time to spend on accounting. These automations can keep your accounting records in order, track business expenses and generate cash flow statements automatically, or create invoices based on retainer structure or time tracking records.

Price: From about S$ 39/month for entry-level, S$ 65/month standard, and S$ 88/month premium plans.

4 Aspire

Aspire offers seamless integration with other popular accounting software like Xero, QuickBooks, and MYOB. It provides hourly updates on business spend and allows startups and SMEs to manage finances effectively with features like spend limit settings and an intuitive dashboard. For those looking to generate reports to provide insight for enterprise resource planning, Aspire is a great addition to your selection of accounting apps.

Although it currently lacks inventory management, Aspire is continuously updating its features to better serve its users.

Price: Custom pricing depending on selected business financing services.

5 FreshBooks

FreshBooks is designed specifically for service-based businesses, freelancers, and independent contractors. It offers useful accounting features such as invoicing, time tracking, and payment processing, allowing users to create professional invoices and send them directly to clients.

FreshBooks excels in providing a user-friendly experience, making it an excellent choice as it allows businesses to take care of basic tasks without needing extensive accounting knowledge.

Price: From approximately S$ 28/month (Lite), S$ 51/month (Plus), up to S$ 87/month (Premium).

6 Wave

Wave is often considered the best free accounting software for those without payroll needs. The free tier tracks expenses and cashflow allows unlimited invoice creation and comes with a basic dashboard that centralises all your accounting data.

Although Wave provides a receipt scanning service at an additional cost, its overall features make it one of the easiest accounting programs for small businesses. The paid tier also connects to your bank accounts and can automatically import transactions.

Price: Free for core accounting and invoicing; optional paid services (e.g., payroll or payments) cost extra.

7 Zoho Books

Zoho Books offers a comprehensive suite of features tailored to small and medium-sized businesses. Core features include invoice creation, payment tracking, automated recurring invoices, and expense management.

It also supports client management, multilingual invoicing, payments in multiple currencies, and generates various financial reports, making it a versatile tool for business accounting. It also comes with a free Timesheet module that allows time tracking on different projects.

Finally, Zoho also has an extensive business suite that are compatible with each other, covering grounds for inventory tracking, CRM, and business intelligent software.

Price: Free plan available; paid plans typically start around S$ 10/month.

8 MYOB

MYOB is tailored for small and medium-sized businesses, offering essential functionalities for GST compliance and budgeting. It provides customisable invoices, payment management, and recurring invoices, making it a reliable choice for SMEs.

MYOB’s features ensure that businesses can maintain accurate financial records and adhere to tax regulations.

Price: From approximately S$ 20–50 per month, depending on the product tier.

9 SAP Business One

SAP Business One is designed to integrate multiple business operations, making it ideal for mid-sized companies. While it can be expensive, its comprehensive features and ability to integrate with other business tools justify the cost for businesses looking for an all-in-one solution.

Price: Custom enterprise pricing, often starting around S$ 61 per user/month for basic setups.

10 NetSuite

NetSuite is tailored for larger small businesses, offering advanced inventory management and scalability. It integrates with Oracle’s CRM solutions and provides e-commerce integration, enhancing overall business operations.

NetSuite’s robust features make it suitable for businesses looking to grow and expand their operations. This is also one of the few double entry accounting software available for small businesses.

Price: Enterprise-level custom pricing, typically starting at several thousand SGD per month based on configuration and modules.

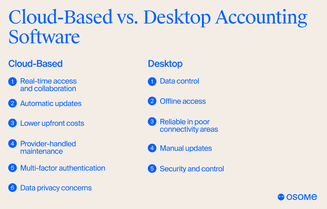

Cloud-Based vs. Desktop Accounting Software

Choosing between cloud-based and desktop accounting software depends on various factors, including accessibility, cost, and data control. Cloud-based accounting systems allow for remote access, making them ideal for businesses that require flexibility and real-time data access. These systems often come with automatic updates and maintenance handled by the provider, reducing the burden on businesses. However, they also require strong data security measures to protect sensitive information from potential breaches.

On the other hand, desktop accounting software offers complete data control, as all information is stored locally. This can be advantageous for businesses in areas with poor internet connectivity, as desktop software does not depend on internet access for functionality. While desktop solutions provide significant advantages in data control and offline access, they may require more manual updates and maintenance.

Advantages of cloud-based accounting software

Cloud accounting software provides real-time access to financial data, which enhances collaboration and decision-making. The ability to access your financial records from anywhere is a significant advantage, especially for business owners who need to manage their finances on the go. Automatic updates ensure that users always have the latest features and security patches, reducing the burden of maintenance. Additionally, cloud-based systems typically come with lower upfront costs compared to desktop solutions, making them more accessible for small businesses.

However, businesses must also consider data privacy concerns associated with off-site storage.

Benefits of desktop accounting software

Desktop accounting software offers several unique benefits, particularly in terms of data control and offline access. Since all information is stored locally, businesses have complete control over their data, minimising the risk of unauthorised access. This can be particularly advantageous for companies that handle sensitive financial information and prefer to keep their data on-premises.

One of the most significant advantages of desktop software is its reliability in areas with poor internet connectivity. Unlike cloud solutions, desktop software does not depend on internet access for functionality, ensuring uninterrupted access to your financial records.

Although desktop solutions might require more manual updates and maintenance, they offer robust control and security for businesses that prioritise these aspects.

Choosing the Right Accounting Software for Your Small Business

Selecting the best accounting software for your small business is essential. This choice can greatly influence your financial management and operational efficiency. The first step is to understand your business needs and evaluate the specific features required to meet those needs. It’s essential to consider factors like growth potential, industry-specific requirements, and the need for multi-user access.

Budget considerations are also crucial when selecting accounting software. The cost of software can vary widely based on features, user numbers, and whether it’s cloud-based or desktop. It’s important to consider the total cost of ownership, including licensing, training, and ongoing support costs. Cloud accounting solutions can significantly reduce overall costs due to their subscription models, making them an attractive option for small businesses.

Scalability is another key factor to consider. Choosing scalable software ensures that it can meet your evolving business needs as your company grows. This includes the ability to start with a lower version and upgrade as needed, ensuring that the software remains relevant and useful as your business expands.

Assessing your business needs

Identifying specific business needs is the first step towards effective financial management and choosing the most suitable accounting software. Growing businesses may require multi-user access to accommodate additional users without significant cost increases. Additionally, industry-specific needs are vital when selecting software to ensure compliance with unique requirements and standards.

Small businesses need custom accounting software that can categorise their income and expenses. It should also enable them to send invoices and prepare financial reports. It’s important to evaluate the necessary features, such as tracking invoices and compliance with taxation standards, to find the right software that meets your business’s unique requirements.

Budget considerations

When selecting accounting software, budget considerations play a significant role. The purchase cost of desktop accounting software typically involves a one-time purchase, while cloud-based solutions often operate on a subscription model. Pricing can vary widely based on features, user numbers, and whether the software is cloud-based or desktop. Understanding your user access needs can help dictate the choice of accounting software, ensuring that it fits within your budget.

Cloud accounting solutions can reduce overall costs associated with traditional accounting systems due to their subscription models. This can be particularly advantageous for small businesses looking to minimise upfront expenses while still accessing essential accounting features.

It’s important to consider the total cost of ownership, including licensing, training, and ongoing support, to ensure that the chosen software remains cost-effective in the long run.

Scalability

Scalability is vital for small businesses to adapt to changing market conditions and operational demands. Choosing scalable software ensures that it can meet your evolving business needs as the company grows.

A key consideration for scaling accounting software is the ability to start at a lower version and upgrade as needed, ensuring that the software remains relevant and useful as your business expands.

Implementation and Training

Implementing new accounting software and training employees on its use are crucial steps for successful adoption. The initial setup process includes configuring settings, personalising features, and importing existing financial data. Ensuring compatibility with other systems and importing recent transactions from online financial accounts are essential for a smooth transition.

Employee training is equally important to ensure that staff are proficient in using the new software effectively. Training can be conducted through workshops, online courses, and hands-on sessions tailored to the needs of the users.

Establishing a support system is crucial for addressing common issues during the implementation process, ensuring that any problems are resolved quickly and efficiently.

Setting up the software

Setting up accounting software requires configuring various settings. These include the chart of accounts, tax codes, payment methods, and user permissions. The setup process can vary significantly in duration, from a few minutes to several hours, depending on the complexity of the software and the amount of data to be imported. Most accounting software solutions can import spreadsheets, facilitating a smoother transition and reducing the risk of data entry errors.

During setup, the software typically imports recent transactions from online financial accounts covering up to 90 days. Tracking income and expenses involves adding accounts, clients, and vendors, ensuring that all financial data is accurately recorded and categorised. Manual transaction input remains an option for users uncomfortable with integration.

Employee training

Employee training is crucial to ensure that staff are proficient in using the new accounting software effectively. Methods for training include in-person workshops, online courses, user manuals, and video tutorials. Tailored training ensures that employees can effectively utilise the new software in their daily tasks, improving overall efficiency and accuracy in financial management.

Troubleshooting common issues

Establishing a support system is crucial for addressing common issues during the software implementation process. Providing clear documentation, support resources, and access to user forums can help resolve problems quickly and efficiently. Having a dedicated support team or access to customer service ensures that any issues that arise are dealt with promptly, minimising disruptions to business operations.

Security and Compliance in Accounting Software

Ensuring data security and regulatory compliance are top priorities for small businesses when selecting accounting software. Effective data security measures can protect sensitive information from unauthorised access. Automatic updates in cloud accounting software ensure that users remain compliant with regulations without manual intervention, reducing the risk of non-compliance and associated penalties.

Compliance with local regulations is essential for avoiding legal penalties and maintaining business credibility. Accounting software must comply with Singaporean data protection and financial regulations to safeguard businesses. These features help facilitate compliance with complex tax regulations, ensuring that businesses adhere to local laws and avoid legal issues.

Data encryption and access controls

Data encryption is crucial for protecting sensitive information stored in accounting software from unauthorised access. Advanced encryption methods make confidential financial data unreadable to unauthorised users, ensuring that sensitive information remains secure. Implementing user access controls based on roles helps safeguard financial information, ensuring that only authorised personnel can access specific data.

Role-based access controls can significantly enhance the security of financial data in accounting applications. Establishing strict access controls and regularly reviewing user permissions are essential steps in maintaining data security and preventing unauthorised access to sensitive financial information.

Compliance with local regulations

Accounting software must comply with local regulations to ensure that businesses avoid legal penalties and maintain credibility. In Singapore, for example, accounting software must adhere to data protection and financial regulations to safeguard businesses.

The software helps facilitate compliance with complex tax regulations, ensuring that businesses adhere to local laws and avoid legal issues.

Summary

Choosing the right accounting software for small businesses is crucial. From automated bookkeeping to real-time financial monitoring, the right software can save time, reduce errors, and provide strategic insights. Some core functionalities to go after include expense tracking, invoicing and billing, and compliances, all of which play vital roles in effective financial management.

By understanding your business needs, budget considerations, and the importance of scalability, you can make an informed decision on the best accounting software for your business. Whether you opt for cloud-based or desktop solutions, ensuring data security and compliance with local regulations is essential. With the right tools and proper implementation, small businesses can achieve better financial oversight and growth.