LLP vs Pte Ltd: The Ultimate Guide to Choosing the Right Business Structure

- Published: 12 November 2024

- 9 min read

- Starting a Company

Heather Cameron

Author

From expert guidance and helpful accounting tips to insights on the latest trends in fintech, Heather is here to empower entrepreneurs and small business owners in Singapore with great content. With a background in digital marketing spanning eight years, she has experience writing for various industries and audiences. As Osome’s copywriter, she’s here to inform and inspire our readers with great storytelling.

Nisah Rahim

Reviewer

Nisah Rahim is our go-to expert reviewer for all things Corporate Secretary-related in Singapore. As the Corporate Secretary Team Lead and content reviewer, Nisah meticulously examines our blog posts to ensure we provide comprehensive information on Corporate Secretary services such as local regulatory compliance, managing board meetings, maintaining company records, and providing expert advice on corporate governance matters.

Jiaping Zhang

Reviewer

Jiaping, CA Singapore and SCTP member, is our Corporate Tax Manager based in Singapore with a decade of experience in Singapore corporate tax. With in-depth knowledge of Singapore corporate tax law and regulations, she can help with corporate tax compliance that matters to every company.

Deciding whether to set up a limited liability partnership (LLP) vs private limited company (Pte Ltd) is a critical step for any entrepreneur. In this guide, we will break down the differences between these business structures, covering aspects like liability, management, taxation, and compliance to help you make an informed decision.

Key Takeaways

- A limited liability partnership (LLP) means enjoying limited liability protection with a flexible management structure, while a private limited company (Pte Ltd) operates as a separate legal entity offering distinct advantages in stability and credibility.

- Taxation and compliance differ significantly between the two: LLPs benefit from pass-through taxation, while Pte Ltds face additional annual compliance requirements and corporate tax obligations.

- Choosing between LLP and Pte Ltd involves considering factors such as liability protection, ownership transferability, and capital-raising capabilities, making consultation with legal counsel advisable.

Understanding Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) is a business structure that provides a separate legal entity status, allowing partners to protect their personal assets from liabilities that exceed their investment. This means that partners are not personally liable for the company’s business debts incurred beyond their investment, protecting their personal assets from business liabilities. LLPs operate as a separate legal entity, allowing it to own assets and enter into contracts independently of its partners.

One of the significant attractions of a limited liability partnership (LLP) is its flexibility in management. Unlike a limited partnership, where management is typically centralised, partners in an LLP can manage the business collectively, fostering a collaborative environment. Additionally, LLPs provide a separate legal identity, meaning creditors cannot seise partners’ personal and business assets due to the company’s actions.

Considering which type of company to opt for can be complex. Osome is here! Our comprehensive company incorporation services will guide you through the process. A team of professionals can handle the legalities and ensure that your company is set up for success.

A limited liability partnership (LLP) must have a partnership agreement to outline the rights and responsibilities of each partner, further ensuring smooth business operations.

Exploring Private Limited Company (Pte Ltd)

A Private Limited Company (Pte Ltd) is a separate legal entity that offers limited liability protection to its shareholders. This means that shareholders are only at risk of losing their investment in the company and are not held personally liable for the company’s business debts. This structure is widely preferred in Singapore due to its tax benefits, robust legal framework, and its separate legal entity status. Private limited companies benefit from a structured governance system that enhances their operational credibility. The shareholders’ limited liability ensures their personal assets remain protected from company debts, because they are considered a separate legal entity.

One of the key features of a private limited company is its ability to operate independently of its shareholders. It can own assets, enter into contracts, and sue or be sued in its name, which provides a level of stability and credibility that many investors and clients find attractive. This structure allows for easy transfer of shares, making it simpler to attract investors or exit the business.

Private limited companies must appoint at least one local director and a corporate secretary, ensuring that the business adheres to local regulatory standards. This requirement, while adding to the administrative burden, helps maintain high governance standards and investor confidence.

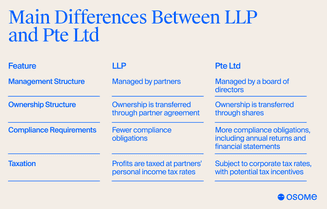

Key Differences Between LLP and Pte Ltd

When comparing a limited liability partnership (LLP) and a private limited company (Pte Ltd), understanding the key differences can guide you in choosing the right structure for your business.

Management and ownership structure

There are some differences in management and ownership structure. In a limited liability partnership (LLP), partners manage the business collectively, which allows for a more informal management structure. This contrasts with a private limited company (Pte Ltd), where the management is typically conducted by a board of directors, adding a layer of formal governance. The LLP requires the appointment of at least one local manager but does not necessitate a corporate secretary, unlike the private limited company, which mandates this role.

Ownership in a Pte Ltd company is easily transferable through shares, facilitating smooth changes in ownership without disrupting operations. In contrast, transferring ownership in an LLP requires the agreement of all partners, which can be a more cumbersome process.

Compliance and reporting requirements

Compliance requirements for a private limited company include preparing unaudited financial accounts if it qualifies, making it distinct from LLPs in terms of regulatory demands. Pte Ltd companies must maintain a register of shareholders and directors, hold annual meetings, and file annual returns and financial statements. They also need to adhere to corporate tax rates, which differ from personal income tax rates applicable to LLP partners. These requirements ensure transparency and accountability but also add to ongoing compliance costs.

On the other hand, LLPs have fewer compliance obligations and may not require corporate secretarial reporting for minor updates, streamlining ongoing operations. They are not required to hold annual meetings or file annual returns, making their regulatory compliance less demanding. However, LLPs must maintain updated records of their transactions and financial status to stay compliant with local laws.

Taxation and financial benefits

The taxation structure for LLPs and Pte Ltd companies differs significantly. An LLP is treated as a pass-through business entity for taxation, meaning the profits are taxed at partners' personal tax rates rather than corporate tax rates, offering potentially advantageous tax benefits based on the partners' income levels.

In contrast, a Pte Ltd is subject to corporate tax rates, which can be advantageous due to various corporate tax rate exemptions and incentives. The corporate tax rate for a Pte Ltd is 17%, but effective tax rates can be reduced significantly after applicable deductions. This structure can provide substantial tax benefits, making it attractive for larger businesses seeking growth and expansion opportunities. LLPs allow partners to be taxed at their personal tax rates, which can be advantageous for those in lower tax brackets. Pte Ltd companies can also draw benefits from specific tax exemptions.

Incorporation Requirements for LLP and Pte Ltd

Incorporating an LLP or a Pte Ltd requires different steps and documentation. An LLP needs at least two partners and one local manager, along with personal identification and proof of address. The registration is valid for one year and must be renewed annually. The registration fees for an LLP are S$ 115, making it affordable for small businesses and startups. Both LLPs and Pte Ltds also need a registered office address in Singapore.

In contrast, incorporating a Pte Ltd demands compliance with the corporate regulatory authority and may also include a solvency or insolvency declaration. A Pte Ltd needs a local director and a company secretary, must file annual returns and statements, hold annual general meetings, and appoint auditors unless exempt. The registration fees are S$ 315, reflecting its more extensive regulatory framework.

Liability Protection and Business Risks

Entrepreneurs often choose a limited liability partnership or a private limited (Pte Ltd) company for the limited liability protection they provide. In a Pte Ltd, shareholders’ personal assets are protected from the company’s debts and obligations, minimising personal financial risk and making it a safer choice for many business owners.

In an LLP, partners have limited liability confined to their investment in the business, although they can be held personally liable for their own wrongful act but not for the misconduct of other partners.

Furthermore, a private limited company offers perpetual succession, allowing the company to operate regardless of changes in ownership or the death of shareholders. This ensures business continuity and stability, unlike a limited liability partnership, which may dissolve upon a partner’s death or resignation.

Raising Capital and Attracting Investors

Raising capital is vital for business growth, and attracting investors can significantly impact success. Pte Ltd companies can issue shares to raise funds, making it easier to secure external financing for expansion and development.

However, LLPs are often perceived as more informal, making it challenging to attract significant investment. While they can raise capital through partner contributions, they lack the flexibility of a Pte Ltd in accessing a broader investor base.

How To Choose the Right Business Structure?

Selecting the most suitable business structure involves considering various factors, including operational efficiency and future growth potential. An LLP enables partners to combine resources and enhance operational efficiency while minimising individual liability.

For businesses seeking long-term stability and easier capital access, a private limited company may be better. Its perpetual existence ensures business continuity regardless of ownership changes. Moreover, its structured governance and compliance can instil confidence in investors and stakeholders.

Ultimately, the decision should align with your specific business needs and goals. Consulting with legal counsel can clarify the implications of each structure and guide you in making the right choice.

Professional Services for Business Incorporation

Professional service providers are vital for both LLP and Pte Ltd incorporation and ongoing compliance. They offer regulatory compliance support and assist with administrative tasks, ensuring your business meets all legal requirements.

Engaging professional services firms, law firms, and accounting firms can ease the burden of corporate secretarial reporting and other compliance obligations, allowing you to focus on core business operations. They provide expertise in maintaining records, seeking tax exemptions, filing necessary documents, and staying updated with local laws.

Professional services also offer ongoing support post-incorporation to ensure compliance. This continuous assistance mitigates risks and maintains business integrity, making it a worthwhile investment for any entrepreneur.

Need assistance with registering a company in Singapore? Partner with our team of experts for reliable and efficient incorporation services. Osome can help you navigate the process efficiently and ensure compliance with all legal requirements. Contact us today!

Summary

Choosing between an LLP and a Pte Ltd is a significant decision that can shape the future of your business. Both structures offer protection of limited liability, but they differ in management, compliance, taxation, and capital-raising capabilities. Understanding these differences is critical to making an informed choice that aligns with your business goals.

Whether you opt for the flexibility of an LLP or the structured governance of a Pte Ltd, choosing wisely between business structures will provide a solid foundation for your success. Consider your specific needs, seek professional advice, and make a decision that supports your vision for growth and stability.