Tax Identification Number (TIN) in Singapore: Your Essential Guide

- Modified: 2 February 2026

- 10 min read

- Tax & GST

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

If you’re trying to understand what a Singapore tax identification number is, look no further. Whether for individuals or businesses, a TIN is essential for compliance with tax laws and seamless financial operations. This concise article will explain the Singapore tax identification number, why it's needed by the Inland Revenue Authority, how to identify yours, and its role in your tax dealings — providing the clarity you need without unnecessary complexity.

Key Takeaways

- A Tax Identification Number (TIN) in Singapore is a unique identifier used for tax filing and financial transactions, with different formats for individuals (TRN or NRIC/FIN) and business entities (UEN).

- The Inland Revenue Authority of Singapore (IRAS) issues TINs for individuals, often matching the NRIC number for citizens and permanent residents, while a Foreign Identification Number (FIN) is allocated to foreigners, and UENs are issued to entities by various government agencies such as the Accounting and Corporate Regulatory Authority (ACRA).

- TINs are essential for financial transactions and compliance in Singapore required for activities such as tax filings, opening bank accounts, CPF contributions, and obtaining import/export permits, necessitating accurate record-keeping and being informed on tax regulations.

What Is the Singapore Tax Identification Number (TIN)?

The Tax Identification Number (TIN) in Singapore is a mandatory code issued by the Inland Revenue Authority of Singapore (IRAS) to all tax-paying individuals and entities. Its format varies depending on the type of taxpayer: citizens and permanent residents receive an NRIC, foreign individuals get a FIN, and businesses are assigned a UEN. While most TINs are 9 characters long, some may have a different length depending on the identifier type.

Far from being just a random set of digits, the TIN serves as a unique identifier in tax filing, financial transactions, and employment procedures. It plays a crucial role in legal tax compliance, accurate record-keeping, and efficient administration for all taxpayers.

Whether you are a citizen, permanent resident, foreign individual, or business entity, you are assigned a specific TIN, which simplifies tax monitoring and helps identify discrepancies quickly.

By the way, for those looking to establish their business presence in Singapore, our expert company incorporation services for foreigners can help ensure a smooth and compliant setup.

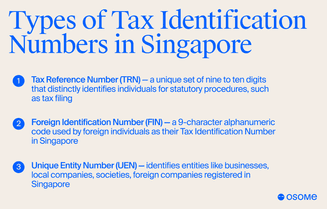

Types of Tax Identification Numbers in Singapore

TINs in Singapore are issued by the Inland Revenue Authority of Singapore (IRAS) for individuals and businesses, with different identifiers depending on the type of taxpayer.

TINs for citizens and permanent residents

Singapore citizens and permanent residents are assigned a Tax Reference Number (TRN), which corresponds to their National Registration Identity Card (NRIC). This number is automatically assigned when an individual turns 15 or obtains residency. The TRN serves as a unique identifier for tax compliance, filing, and financial transactions, helping individuals navigate the Singapore tax system efficiently.

TINs for foreign individuals

Foreign residents in Singapore receive a Foreign Identification Number (FIN) as their TIN. The FIN is issued to foreigners holding valid work passes or long-term passes and is used for all tax-related matters, government reporting, and official documentation, ensuring each individual is uniquely identifiable for administrative purposes.

TINs for businesses

Business entities, including companies, societies, and non-profit organisations, are assigned a Unique Entity Number (UEN). The UEN is issued by government agencies such as the Accounting and Corporate Regulatory Authority (ACRA) and serves as the official identifier for all tax filings, regulatory compliance, and government interactions, providing a clear and standardised way to recognise businesses in Singapore.

The Format of Tax Identification Numbers

The format of Singaporean TINs, for both individuals and businesses, depends on the taxpayer type and follows specific alphanumeric structures.

TIN format for individuals

Individual TINs in Singapore — whether Tax Reference Numbers (TRNs) or Foreign Identification Numbers (FINs) — share the same overall structure:

#0000000@ (example: S1234567D)The first character reflects the individual’s status and may be S, T, F, G, or M. It is followed by seven serial digits assigned to the individual, while the final character is a checksum letter used for verification.

This standardised format allows tax authorities to consistently identify individuals while accounting for differences in residency and immigration status.

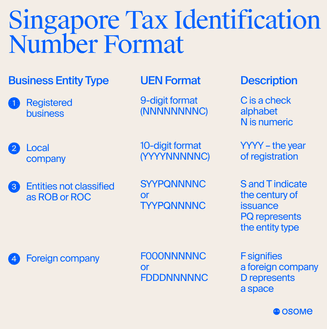

TIN format for business entities

For business entities, the Singapore Tax Identification Number is issued as a Unique Entity Number (UEN). A UEN is a 9- or 10-character alphanumeric identifier, with the format determined by the entity type, year of issuance, and issuing authority.

Common UEN formats include:

- Registered businesses: NNNNNNNNC (example: 53123456K)

- Local companies: YYYYNNNNNC (example: 201912345G)

- Other entity types: formats that include an entity-type code (example: S88SS0001A)

Foreign companies registered in Singapore are also assigned UENs, which typically begin with F to distinguish them from local entities.

Example: F20201234NThis structured numbering system enables clear identification, tracking, and administration of business entities across Singapore’s government agencies.

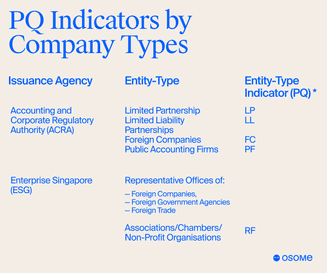

*PQ corresponds to business entity types and can fall into one of the categories presented in the table below.

How To Get Your Singapore Tax Identification Number

The process of obtaining a TIN in Singapore varies for individuals and businesses.

Individual TIN

For individuals, the application for a Singapore Tax Identification Number starts with an IRAS Unique Account or SingPass. Singapore citizens must provide their National Registration Identity Card Number, while foreigners should provide their Foreign Identification Number when applying for a TIN. After the submission and review process, the Tax Reference Number is issued within five working days.

Business TIN

On the other hand, businesses need to register with the Accounting and Corporate Regulatory Authority of Singapore (ACRA) to acquire a Unique Entity Number (UEN) as their tax identification number. When the registration process is complete, ACRA issues a Certificate of Incorporation, which includes the UEN. Once obtained, the UEN acts as a permanent identifier for the entity and is critical for engagement with various government agencies, financial institutions, and other stakeholders. It does not require periodic renewal.

Using TIN for Financial Transactions and Compliance

In Singapore, a tax identification number extends beyond being a mere number on paper; it fulfils a significant role in transactions with numerous financial institutions and compliance requirements. Both individuals and businesses are required to use their Tax Identification Number for filing taxes and to access tax-filing services online.

The TIN is also used for a range of government transactions, such as remitting Central Provident Fund (CPF) payments.

Bank accounts

When opening a bank account in Singapore, the necessary documents include NRIC or government-issued tax documents displaying income tax filings, which inherently contain the individual’s TRN. These documents must be within three months of the application date, and the details must match the information given on the bank account application form.

Import and export permits

For businesses engaged in trade, a tax identification number is required to obtain import and export permits to tax foreign income or expenses.

The Unique Entity Number (UEN) serves as the TIN for businesses and is required for filing corporate tax returns or applying for import/export permits.

Financial compliance

The tax identification number system in Singapore is also pivotal in financial compliance. The Foreign Identification Number (FIN) enables the government to monitor and ensure that taxpayers are meeting their tax obligations while residing in Singapore.

When making Central Provident Fund (CPF) contributions, businesses must declare TINs for themselves and their employees to facilitate the government’s tracking and taxation of CPF transactions.

Managing Your Tax Identification Number: Best Practices

Having learned the mechanics of Singapore’s TIN, we can now discuss some best practices for its efficient management. These practices can help individuals and businesses maintain accurate documentation, regularly check tax records, and stay informed on tax laws.

Accurate tax filing

Accurate documentation is the cornerstone of financial compliance and maintaining proper records for tax-filing purposes. Companies in Singapore are required to keep proper financial records for at least five years from the relevant Year of Assessment.

Having good record-keeping practices enables companies to stay aware of their financial status and supports sound business decision-making.

Monitoring tax responsibilities

Regularly checking tax records is also crucial to ensure their accuracy and to identify and rectify any discrepancies as soon as possible. Keeping systematic accounting records and being able to explain all transactions is essential; bank statements alone are not sufficient for record-keeping.

It’s also advisable to adopt electronic record-keeping systems to reduce manpower costs and enhance the tracking of business transactions.

Staying informed on tax regulations

In the ever-evolving financial landscape of Singapore, staying informed on tax laws and tax-related matters is paramount. This will not only help you stay compliant but also take full advantage of available benefits or deductions.

Regular updates to the list of participating jurisdictions for the Common Reporting Standards (CRS) directly affect the reporting and due diligence duties of businesses in Singapore.

How Osome Can Help

Understanding which Tax Identification Number applies to you, and how it’s used, is only one part of staying compliant in Singapore. Osome helps individuals and businesses handle their tax and compliance obligations without getting lost in administrative details.

For business owners, Osome supports company registration, ensuring the correct Unique Entity Number (UEN) is issued and properly reflected across filings, banking, and tax records. Ongoing accounting and tax services help keep all IRAS submissions accurate and on time, using the correct identifiers at every stage.

For founders relocating to Singapore or hiring foreign talent, Osome can also assist with structuring, payroll, and ongoing compliance, so TIN-related requirements are handled correctly from day one. This allows businesses to focus on growth while Osome takes care of the paperwork behind the scenes.

Summary

In this journey through the tax landscape of Singapore, we’ve unravelled the concept of the Tax Identification Number (TIN), its different types, formats, and usage. We’ve also discussed how to acquire a tax identification number and some best practices for managing it.