What Is a Nominee Director, and How Do You Appoint One in Singapore?

- Modified: 4 December 2023

- 12 min read

- Starting a Company

Gabi Bellairs-Lombard

Business Writer

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Navigating the complexities of setting up and running a business in Singapore can be challenging, especially for foreign entities. One key aspect of this process is appointing a nominee director to ensure compliance with local laws and establish a local presence. Appointing a nominee director is important, but it can be daunting for a business owner looking to open a business in Singapore — we're here to show you how to do it! In this guide, we’ll unveil the concept of a nominee director, their roles and responsibilities, eligibility criteria, the appointment process, and potential risks. Let’s dive in!

What Is a Nominee Director?

Key Takeaways

- A Nominee Director is an individual appointed to a company’s board to represent another person or entity and provide a local presence for foreign entities.

- Appointing a nominee director requires identifying suitable candidates, executing service agreements, gathering necessary documents and completing the application process with ACRA.

- Professional assistance is essential when appointing a nominee director in Singapore to ensure compliance and mitigate potential risks.

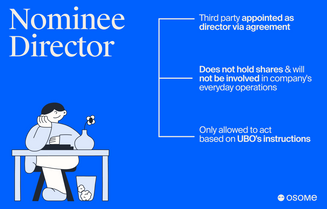

A nominee director is an individual who is appointed to a company’s board to represent another person or entity, fulfilling legal and regulatory requirements. This is a common practice in Singapore, as companies need at least one local resident director to comply with the Companies Act. Although nominee directors may know about the company’s affairs and offer valuable advice to the board, their primary role is to allow the appointing person or organisation to influence the company without serving as shareholders or directors.

Unlike executive directors, nominee directors typically lack executive authority over the company’s management or decision-making processes. Their primary role is to provide a local presence for a Singapore company established by a foreign entity. This enables the company to navigate Singapore's legal and regulatory framework more effectively, especially when the foreign business owner does not have an Employment Pass.

A nominee director is essentially the on-the-ground individual taking care of everything regarding local compliance with the relevant laws while the business owner runs and grows their company in Singapore without worrying about all the admin. Nominee director services should be part of every foreign business's plans when looking to succeed in the Singaporean market and when going through the company incorporation process.

Does Your Company Need a Nominee Director?

For foreign entities aiming to expand their company in Singapore, appointing a nominee director could be a requisite to abide by local regulations and establish a local foothold. The Singapore government requires a local director to ensure accountability if a company violates any laws, preventing foreign owners from fleeing and evading responsibility for any legal issues that may arise. As per Singapore’s Companies Act, every Singapore company must have at least one resident director on their board of directors at all times. A nominee director can fulfil this requirement, provided they are a citizen or permanent resident of Singapore with a permanent address located in Singapore.

Appointing a nominee director can help your Singapore company in the following ways:

- Navigate the legal and regulatory framework

- Establish a local presence

- Gain access to beneficial local knowledge, especially for foreign business owners who do not have an Employment Pass

If your company fails to appoint a locally resident director within six months of incorporation, the company members may be subject to legal penalties for non-compliance. The nominee director helps mitigate these risks while ensuring local laws and regulations are adhered to.

Roles and Responsibilities of a Nominee Director in Singapore

Nominee directors in Singapore have a range of responsibilities under Singapore’s Companies Act, such as ensuring compliance with local laws, providing a local address, and acting in the best interests of foreign companies as the company director. In some cases, the executive director may also work closely with the company secretary to fulfil these duties.

Let's have a look at these responsibilities in greater depth.

Compliance with Local Laws and Regulations

A nominee director must ensure the company adheres to local laws and regulations to avoid penalties and legal consequences. Filing annual returns, conducting annual general meetings and keeping accurate accounting records are all part of a company’s requirements. Compliance with these tasks is essential for efficient business operations. When the nominee director fulfils these compliance duties, they assist the company in maintaining a positive standing with the authorities and minimising legal risks.

Providing a Local Address and Representation

Providing a local address and representation is crucial for establishing a company’s presence in Singapore and building relationships with local stakeholders. The nominee director must possess a local residential address in Singapore. By offering a local address and representation, the nominee director serves as a contact point for local authorities, stakeholders, and business partners, thus facilitating the establishment of a presence in the local market and the creation of trust with local stakeholders.

Fiduciary Duty and Acting in the Company's Best Interests

Nominee directors have a fiduciary duty to act in the company's and its shareholders' best interests. This means they should always strive to make decisions that benefit the company and avoid any actions that may harm its reputation or financial standing. By fulfilling their fiduciary duty, nominee directors help protect the company’s interests and maintain its integrity.

Eligibility Criteria for Nominee Directors in Singapore

Before appointing a nominee director, verify that they satisfy the eligibility criteria set by the Singapore government. These criteria include Singapore citizenship or permanent residency, age requirement, and a clean criminal record with no disqualifications.

Further criteria are broken down below to give you a full picture of what requirements your nominee director needs to meet.

Singapore Citizenship or Permanent Residency

Nominee directors must be Singapore citizens or permanent residents with a local address. This requirement ensures that the director has a strong connection to Singapore and can be held accountable for the company’s actions within the country. It also ensures compliance with the Companies Act, making it an important part of Singapore law for at least one resident director for every company incorporated.

Age Requirement

Nominee directors must be at least 18 years of age. This age requirement guarantees that the individual appointed as a nominee director is legally qualified to occupy the position and helps maintain the credibility and compliance of the company’s directorship.

Clean Criminal Record and No Disqualifications

To be eligible as a nominee director, an individual must have a clean criminal record. They should also not have been disqualified from holding director positions. This requirement attests to the nominee director’s credibility and trustworthiness, demonstrating they have not been involved in any fraudulent or dishonest activities and can be trusted to manage the nominee director in Singapore responsibilities.

It also helps ensure compliance with legal requirements and regulations regarding directorship positions.

Appointing a Nominee Director: Step-by-Step Process

Once you understand a nominee director's eligibility criteria and responsibilities, the next step is to appoint one. The process involves:

- Identifying a suitable candidate

- Executing a service agreement

- Gathering necessary documentation

- Completing the application and verification process with the Accounting and Corporate Regulatory Authority (ACRA)

We will now examine each step in more depth.

Identifying a Suitable Nominee Director

First, you must choose a suitable individual or professional service provider to act as a resident director of your company. This could be someone you know personally, a trusted business associate, or a corporate services provider, as long as they are a Singapore citizen. Whichever option you choose, it’s essential to conduct thorough due diligence to ensure the nominee director is competent and reliable, possesses the necessary qualifications, and meets the eligibility criteria. It brings great peace of mind knowing you have a trusted and knowledgeable local director while you are offshore.

Executing a Nominee Director Service Agreement

After identifying a suitable candidate, you’ll need to execute a Nominee Director Service Agreement outlining the nominee director's terms, conditions, and responsibilities. This agreement should clearly state the nominee director’s duties, any limitations on their powers, and the preferred method of resolving disputes. This is an essential part of the nominee director arrangement, and utilising nominee director services ensures a smooth process.

A thorough agreement review before signing is vital as it offers legal protection, defines roles and responsibilities, and guarantees regulatory compliance.

Necessary Documentation

To appoint a nominee director, you must obtain the required documents, such as the Memorandum and Articles of Association, board resolutions, and incorporation certificates. These documents ensure that the nominee director is properly appointed and that the company complies with local laws and regulations. The documents can be obtained from the company’s registered office or from ACRA.

Application and Verification

Next, you’ll need to apply for the appointment of a nominee director and complete the verification process with ACRA. This involves submitting the necessary documents, including the nominee director’s identity and residential address, which ACRA will verify.

Ensuring a smooth application and verification process helps maintain the company’s compliance with local laws and regulations, including everything relevant to the Companies Act.

Notification and Statutory Obligations

Finally, after appointing a nominee director, you must notify the relevant authorities of their appointment and ensure they fulfil statutory obligations, such as filing annual returns, holding annual general meetings, and maintaining proper accounting records. By notifying the authorities and meeting statutory obligations, the nominee director helps the company maintain good standing with the authorities and minimise legal risks.

What Are The Risks of Hiring a Nominee Director in Singapore?

While hiring a local director in Singapore can benefit your company, potential risks are involved. These risks include

- Legal and regulatory risks: The company might face legal and regulatory risks if any laws or regulations have been breached. This could result in fines, penalties, or worse – imprisonment of the nominee director (you definitely want to avoid this from happening!).

- Reputational risks: Reputational risks may occur if the company is implicated in unethical or illegal activities, damaging the nominee director’s professional standing.

- Financial risks: Financial risks can result from the nominee director’s failure to fulfil their responsibilities, leading to potential losses for the company. This is why it's essential to make it clear what you expect from the resident director before any contracts are signed.

It is important to carefully consider these risks before hiring a nominee director.

Carefully selecting a competent and reliable nominee director with a comprehensive understanding of Singapore's Companies Act, local laws, and regulations is paramount to lessen these risks. Furthermore, clear communication between the company and the nominee director is essential to ensure they fulfill their duties and act in the company’s best interests.

Comparing Nominee Directors and Regular Directors

While nominee and regular directors share similar obligations, there are key differences between the two roles. Nominee directors do not have executive authority or involvement in company management, while regular directors have an executive role that involves making management decisions and overseeing the company’s day-to-day operations. This distinction is important because it helps clarify the roles and responsibilities of each type of director, ensuring the company operates effectively and in compliance with the law.

In essence, nominee directors serve as a local presence for foreign entities in Singapore, helping them navigate the legal and regulatory framework and establish a local presence. On the other hand, regular directors are more involved in the company's daily operations and decision-making processes, driving its strategic direction and growth.

Outsourcing nominee director services is one of the first things we recommend to foreign companies looking to branch out to Singapore, especially if the business owner does not yet have an Employment Pass. Osome is proud to have a team of nominee directors in Singapore who can ensure your business is set up both for success and local compliance from the get-go.

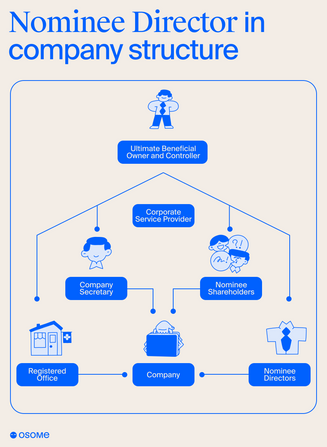

Nominee Directors vs. Nominee Shareholders: Key Differences

Understanding the differences between nominee directors and nominee shareholders is essential for effective corporate governance. Here are the key distinctions:

- A nominee director represents the company and ensures local laws and regulations compliance.

- Nominee shareholders hold shares on behalf of the beneficial owner.

- The same individual can perform both roles, but their responsibilities and legal obligations are distinct.

A nominee director is responsible for managing the company’s affairs and ensuring compliance with local laws, whereas nominee shareholders primarily hold shares for the benefit of the company owner. Both roles are crucial for maintaining the company’s legal and regulatory compliance, but their functions within the company are distinct and should be managed accordingly.

Replacing or Removing a Nominee Director

While replacing or removing a nominee director is possible, it is crucial to remember that a Singaporean company must always retain at least one local or nominee director. If you need to replace or remove a nominee director, you can follow the procedure outlined in the company’s constitution, shareholders agreement, and other legal documents. This might involve submitting a letter of resignation or filing a notification of cessation. External nominee director services can assist you with this if you want to make a change.

When replacing or removing a nominee director in Singapore, it’s crucial to ensure that a suitable replacement is found before the current nominee director resigns or is removed. Failing to do so may result in non-compliance with local laws and potential legal consequences. Seeking professional nominee director services when replacing or removing one can help ensure the process is executed accurately and in accordance with local laws and regulations.

The Importance of Professional Assistance in Appointing a Nominee Director

Appointing a nominee director can be a complex process, and obtaining professional assistance is crucial to ensure compliance with local laws and regulations. A corporate service provider can help guide you through the process of appointing a nominee director, from identifying a suitable candidate to executing the nominee director agreement. Additionally, outsourcing this service can help mitigate the potential risks of hiring a nominee director in Singapore, such as legal and financial liabilities, reputational harm, and conflicts of interest.

In the end, acquiring professional help when appointing a nominee director can facilitate your company’s navigation through Singapore’s legal and regulatory framework, establish a local foothold, and tap into valuable local insights. Working with a trusted corporate service provider ensures that your company’s nominee director is competent, reliable, and adheres to local laws and regulations. It also gives you peace of mind that this aspect of your business is taken care of so that you can focus on the rest.

Summary

In conclusion, appointing a nominee director is critical for foreign companies looking to establish a presence in Singapore. Nominee directors play a crucial role in ensuring compliance with local laws, providing a local address, and acting in the company's best interests. By understanding the eligibility criteria, roles and responsibilities, and appointment process, you can successfully navigate the complexities of appointing a nominee director in Singapore. Additionally, seeking professional assistance can help ensure compliance with local laws and regulations, mitigating potential risks and challenges. Remember, your company's success in Singapore depends on the competence and reliability of your nominee director, so choose wisely.

FAQ

What is a nominee director in Singapore?

Nominee directors in Singapore are local persons appointed to fulfil legal obligations and act on behalf of the company owner, meeting the incorporation requirements that a company must have an executive director locally residing in Singapore. Their responsibilities include convening annual general meetings and acting in the company's best interest.

What is the difference between a nominee director and a shareholder director?

The local nominee director acts on behalf of the business owner, while a nominee shareholder holds shares for the benefit of the company owner.

Is a nominee director legal?

A nominee director is legally required to fulfil the same obligations and liabilities as a formal director under the Singapore Companies Act and Common Law, but it is a non-executive role. They are also subject to the same risks and must obtain appropriate insurance to mitigate this liability. Thus, a nominee director is a legal requirement for foreign-owned companies in Singapore.

What are the criteria for a nominee director?

A Singapore nominee director should have business skills and experience, understand company financials, provide independence in decision-making, and display high ethical standards. They should also be a representative of the interests of all shareholders.

Is it safe to be a nominee director in Singapore?

Choosing a nominee director in Singapore is safe and advisable, as many organisations have succeeded with the practice. It is a viable option to help corporate operations in the country.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?