Setting Up a Company Limited by Guarantee in Singapore

- Modified: 3 April 2025

- 12 min read

- Starting a Company

Heather Cameron

Author

From expert guidance and helpful accounting tips to insights on the latest trends in fintech, Heather is here to empower entrepreneurs and small business owners in Singapore with great content. With a background in digital marketing spanning eight years, she has experience writing for various industries and audiences. As Osome’s copywriter, she’s here to inform and inspire our readers with great storytelling.

Nisah Rahim

Reviewer

Nisah Rahim is our go-to expert reviewer for all things Corporate Secretary-related in Singapore. As the Corporate Secretary Team Lead and content reviewer, Nisah meticulously examines our blog posts to ensure we provide comprehensive information on Corporate Secretary services such as local regulatory compliance, managing board meetings, maintaining company records, and providing expert advice on corporate governance matters.

Kelly Yik

Reviewer

Kelly Yik, our Accounting Team Lead based in Singapore, ensures that the team meets quality standards and follows accounting standards (SFRS) while remaining compliant with all the authorities' rules and regulations in Singapore. With six years of experience in Singapore accounting, she knows the ins and outs of financial reporting standards, GST, and corporate tax like nobody's business. Kelly supports our blog writers by carefully reviewing our content, making sure it's accurate, up-to-date, and packed with helpful tips for Singapore businesses. So, you can trust the info you get on our blog is not only interesting but also reliable!

Imran Marican

Reviewer

Imran Marican, ATA SCTP member, is our Corporate Tax Assistant Manager based in Singapore, with almost a decade of experience in Singapore corporate tax. With in-depth knowledge of Singapore corporate tax law and regulations, he can help with corporate tax compliance that matters to every company. While our business writers transform complicated tax jargon into easy-to-understand concepts, as a reviewer for the Osome blog, Imran ensures our content is accurate and relevant, helping our readers boost their businesses with helpful tips and insights.

A Company Limited by Guarantee (CLG) in Singapore is tailored for non-profit organisations. Unlike traditional private companies or public companies, CLGs have members, not shareholders, who act as guarantors and don’t receive profits. Instead, any income earned is reinvested into the organisation’s goals. This structure combines companies' limited liability with a focus on charitable, educational, and community activities. In this article, we will explore the key characteristics, advantages, and procedures for setting up a CLG in Singapore.

Key Takeaways

- A Company Limited by Guarantee (CLG) is a non-profit corporate entity in Singapore that provides members with limited liability while reinvesting profits to support community-focused objectives.

- CLGs have a distinct corporate status that enhances credibility and allows for partial or even full tax exemption, making them an attractive structure for non-profit organisations.

- The process of incorporating a CLG includes reserving a company name, registering with ACRA, and fulfilling ongoing compliance requirements to maintain operational legitimacy.

What Is a Company Limited by Guarantee?

A Company Limited by Guarantee (CLG) is a corporate entity primarily designed for non-profits that operate with limited liability. Unlike traditional companies that have shareholders, companies limited by guarantee have members who act as guarantors. These members do not receive dividends; instead, any profits generated are reinvested back into the organisation to further its non-profit goals. This structure is particularly advantageous for entities focused on charitable, educational, and non-profit making activities, making it ideal for any business seeking charity status without shareholders.

The primary purpose of a company limited by guarantee is to engage in the business activities of a non-profit organisation. This is distinctly different from for-profit companies, which aim to generate profits for distribution to shareholders.

Thinking of starting a company? Osome offers comprehensive company incorporation services. We will guide you through the legal complexities, ensuring your organisation is set up for success. Contact us today to learn more!

Why Choose a CLG for Your Non-Profit?

In Singapore, a company limited by guarantee is a popular choice for various non-profit organisations, including any trade or professional association, incorporated clubs, professional societies, and charitable entities funded through membership fees

The flexibility and protection offered by this structure make it an ideal choice for organisations with a mission to serve the national or public interest, much like a public limited company in the for-profit sector.

A CLG operates similarly to a limited company, as a separate legal entity, offering a solid foundation for non-profit activities and charity work with limited member liability. This distinguishes it from other companies limited by guarantee or a public company limited, and is a significant draw for organisations such as trade associations and non-profits focused on animal welfare.

Key Characteristics of a Company Limited by Guarantee

A company limited by guarantee is inherently structured as a non-profit entity, which means it does not have share capital. This characteristic is crucial as it underscores the non-profit intent of the organisation. The constitution of a CLG must explicitly state that any profits generated are not to be distributed to its Singapore members but are to be reinvested into the organisation to further its objectives. This ensures that the primary focus remains on serving the public good, similar to a limited company.

CLG members have limited liability, restricting their financial responsibility to a nominal guaranteed amount, often just 1 Singapore dollar. This safeguard minimises financial risk, protecting personal assets during liquidation, which is common in a limited company structure and fosters a sense of security while encouraging business governance participation.

The legal status of a CLG enhances its credibility, enabling it to enter into contracts, own property, and engage in various business activities that require a recognised corporate entity. This corporate status is especially beneficial for non-profit organisations as it bolsters their legitimacy and trustworthiness in the eyes of stakeholders, donors, and the general public.

Company Limited by Guarantee Vs. Other Company Structures

Grasping the differences between a CLG and other company structures, such as trade associations or public companies with share capital, helps in deciding its suitability for your organisation. Unlike companies limited by shares, companies limited by guarantee lack share capital; members’ liability is limited to their agreed contribution during liquidation. This framework suits non-profit goals, as a public company limited by guarantee differs from share-based companies focused on profit-driven business.

Companies limited by guarantee are classified as public limited companies, adhering to distinct regulatory requirements as set out in the Companies Act, without the need for shareholders like traditional public companies. This classification affects governance and financial reporting, much like a public limited company, necessitating a thorough understanding of business regulations before proceeding.

Differences between CLGs and companies limited by shares

One of the primary differences between CLGs and companies limited by shares is how liability is managed. In a CLG, members’ liability is limited to the amount they agree to contribute, providing protection from personal asset loss in the event of bankruptcy. In contrast, companies limited by shares require shareholders to invest in share capital, and their liability is limited to the amount of this share capital.

Moreover, CLGs do not distribute profits to members; instead, any surplus is reinvested into the organisation. This contrasts with companies limited by shares, where profits are distributed to shareholders as dividends. This fundamental difference aligns a public company limited by guarantee with non-profit objectives, making it more suitable for charitable and community-focused business activities.

Differences between CLGs and charitable societies

While both CLGs and charitable societies aim to serve non-profit purposes, they operate under different frameworks. A CLG is a separate legal entity, providing significant financial protection. In contrast, charitable societies are typically organised as groups of individuals focusing on membership or volunteer activities, often with different regulatory requirements.

Managing a charitable trust can incur high costs of establishment and ongoing management, making CLGs a more cost-effective option for many organisations. Additionally, a charitable trust often has complex structures to set aside income for charitable purposes.

The Role of Members in a Company Limited by Guarantee

The role of members of a CLG is crucial in its governance and operation. Their financial contribution is limited to a specified amount they agree to pay if the business is wound up, typically a nominal amount like 1 Singapore dollar. This ensures that members are not personally liable for the company’s debts, protecting their personal assets.

Beyond financial contributions, members engage in CLG governance by voting on key issues detailed in the Constitution (formerly Articles of Association). This participation often involves a commitment to uphold the organisation’s objectives, especially for non-profit operations within companies limited by guarantee, ensuring that the business serves its goals.

The structure of a CLG thus provides a balanced approach to member involvement and financial protection.

Advantages of Company Limited by Guarantee

Establishing a CLG offers numerous advantages, making it an attractive choice for non-profit organisations. One of the primary benefits is the limited liability protection it provides to its members, ensuring that they are not personally responsible for the company’s debts or legal claims. This protection offers peace of mind and encourages more individuals to participate in the organisation’s governance.

Incorporating a CLG, a limited company type, can lead to tax exemptions and several benefits, especially for any business with similar objectives focused on community and charitable activities. The combination of limited liability and access to partial tax exemptions or a complete tax exemption positions CLGs as a favourable structure for many organisations focused on non-profit activities.

Limited liability protection

Members of a CLG enjoy the significant advantage of limited liability protection. This means that their assets are safeguarded from any claims or company debts incurred by the business. In the event of bankruptcy, members are only liable for the nominal amount they agreed to guarantee, typically a small, predefined sum. This protection is a key reason why many non-profit organisations opt for the CLG structure.

This aspect not only protects members but also enhances the overall stability and attractiveness of the organisation. Non-members can be confident that their potential future involvement in the CLG will not jeopardise their personal financial security, encouraging greater participation and support for the organisation’s objectives.

Enhanced credibility and trust

Operating as a CLG significantly enhances an organisation’s credibility and trustworthiness. Being a separate legal entity, a CLG is perceived as a legitimate and dedicated non-profit organisation, which fosters confidence among stakeholders. The liability limitation also reassures stakeholders that their financial risk is minimised, further building trust in the organisation’s operations and mission.

Access to tax benefits

A CLG can access various tax benefits that are particularly advantageous for Singapore members involved in charity work, offering significant financial benefits. For example, tax exemptions may be accessible if the GLC carries on a trade or professional association. If over half of its receipts from membership fees go from Singapore members, that is tax-deductible per the Income Tax Act. This tax-deductible opportunity can significantly reduce their tax burden. The prevailing corporate tax rate set by the Income Tax Act for a CLG is 17%, and taxable income includes income obtained from non-members, with certain income being tax deductible as outlined in the Companies Act. However, certain types of revenue aligned with the organisation’s charitable purposes may qualify for income tax exemptions.

These tax benefits not only enhance the financial viability of a CLG but also enable it to allocate more resources towards its mission for public interest. Achieving charity status can grant a CLG full tax exemption on its income, as well as access to a lower prevailing corporate tax rate. This provides a full tax exemption for organisations focused on non-profit activities. This makes the CLG structure particularly appealing for organisations engaged in activities that serve the national or public interest.

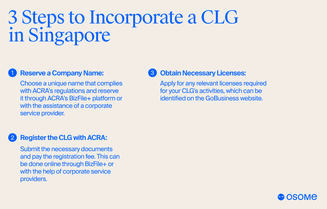

Step-by-Step Guide to Setting Up a CLG in Singapore

Setting up a CLG in Singapore involves several steps, starting with choosing a public company name and reserving it with the Accounting and Regulatory Authority (ACRA). This process ensures that the chosen name is unique and complies with regulatory standards. The fee to reserve your own name is $15, and the approval process can take up to 14 days under certain circumstances.

Once your business's own name is approved, the next step is to register the CLG with ACRA by submitting the necessary documents and paying the registration fee. The entire process can be managed through platforms like BizFile+ or with the assistance of corporate service providers, which help streamline the incorporation process and offer additional services.

Choosing a company name

Selecting an appropriate company name is a pivotal initial step in CLG incorporation. The name should reflect the organisation’s identity and purpose, adhering to ACRA’s legal and regulatory standards. Ensuring the name is unique and not already in use is crucial.

The approval process for a business name involves submitting it to the Accounting and Corporate Regulatory Authority, which can take up to 14 days for approval under certain conditions. Once approved, the name is reserved, allowing the organisation to proceed with the registration process. This step is crucial as it establishes the legal identity of the CLG and ensures compliance with regulatory requirements.

Registration process

Registering a CLG requires submitting an application to ACRA and providing the organisation’s constitution through BizFile+. This can be completed online or via paper, costing S$ 300. The process usually takes about 15 minutes but can extend up to 2 months if additional review is needed.

During the registration process, it’s also important to apply for any relevant licenses required for the organisation’s activities. Information about these licenses can be found on the GoBusiness website, ensuring that the CLG complies with all necessary regulatory requirements.

Post-incorporation requirements

After incorporating a CLG, there are several ongoing compliance requirements to maintain its corporate status. These include filing annual returns with ACRA within seven months after the end of the financial year. This filing ensures that the organisation’s financial information is timely and consistent, meeting regulatory compliance standards.

CLGs must also meet public disclosure obligations and appoint key personnel, including an auditor, within three months and a company secretary, within six months of incorporation. These steps are vital for transparency, accountability, and regulatory compliance.

Can a CLG Apply for Charity Status?

A CLG can obtain charity status by applying. However, it must first meet the eligibility criteria established by the Commissioner of Charities. To apply, the CLG must submit its application within three months of establishment via the Charities Portal. Achieving charity status provides several benefits, including complete tax exemption on income earned, enhancing the organisation’s financial viability.

Being recognised with charity status boosts confidence among potential donors and sponsors, enhancing fundraising capabilities. Additionally, CLGs with charity status can access various funding opportunities and grants that may not be available to other organisational structures.

Regulatory Compliance for CLGs

Regulatory compliance is a crucial aspect of CLGs in Singapore. Companies must appoint an auditor within three months after incorporation and a company secretary within six months. These appointments are necessary to ensure that the organisation adheres to the financial and administrative standards set forth by the Accounting and Regulatory Authority (ACRA).

Additionally, CLGs may need to obtain various licenses depending on the nature of their activities. For instance, if the company’s annual taxable supplies exceed S$ 1 million, GST registration becomes mandatory. Ensuring compliance with the Companies Act and other regulatory compliance requirements is essential for maintaining the legitimacy and operational efficiency of a CLG.

Dissolution and Asset Distribution

Dissolving a CLG involves several steps, which can be voluntary or compulsory. The winding-up process can be classified into members’ voluntary and creditors’ voluntary winding up, depending on the circumstances. In the case of creditors’ voluntary winding up, the company’s assets are liquidated to pay off its debts. Alternatively, if a CLG is struck off, it means that its name has been removed from the registry, effectively dissolving the company.

One important aspect of dissolving a CLG or public limited company is the distribution of remaining funds or assets to organisations with similar objectives, ensuring that the organisation is fully wound up in accordance with regulations. These cannot be distributed to members but must be given to similar organisations or a registered charity. This ensures that the assets continue to serve the public good, benefiting organisations with similar objectives, such as those focused on animal welfare. This remains the case even after the business ceases to exist as a public company limited by shares.

Partnering with experts for the incorporation process can streamline the setup and maintenance of your future company. Osome is here for that. Contact us today and ensure compliance with all legal requirements.

Summary

In summary, a Company Limited by Guarantee offers a robust and flexible structure for non-profit organisations in Singapore. With limited liability protection for members, enhanced credibility, and access to various tax benefits, CLGs are uniquely positioned to achieve their charitable objectives. By understanding the key characteristics, regulatory requirements, and advantages of a Company Limited by Guarantee, organisations can make informed decisions to effectively serve their missions and contribute to the public good. Embrace the potential of a Company Limited by Guarantee (CLG) to create positive change and drive impactful initiatives in your community.