Top 6 Business Bank Accounts in Singapore for 2026

- Modified: 31 October 2025

- 9 min read

- Starting a Company

Gabi Bellairs-Lombard

Author

Gabi's passionate about creating content that inspires. Her work history lies in writing compelling website copy and content, and now specialises in product marketing copy. When writing content, Gabi's priority is ensuring that the words impact the readers. As the voice of Osome's products and features, Gabi makes complex business finance and accounting topics easy to understand for small business owners.

Are you trying to choose a business bank account in Singapore? We compare top contenders, focusing on the criteria that matter most: costs, features, and services. Our guide will help you select an account that suits your business needs and improves your financial management.

Key Takeaways

- Choosing the right business bank account in Singapore involves evaluating factors such as the bank’s reputation, account fees and features, minimum balance requirements, service offerings like integration with accounting software, and convenience regarding branch locations and online banking.

- The top six business bank accounts in Singapore each offer unique features suitable for various business needs, including accounts designed for start-ups, SMEs, multi-currency operations, and digital banking services.

- While accounts like the OCBC Business Growth Account and Airwallex Business Account provide benefits such as cashback and multi-currency capabilities, others like the Maybank FlexiBiz Account offer simplicity and cost-effectiveness with no minimum balance or fees, catering to new business owners seeking to minimise banking costs.

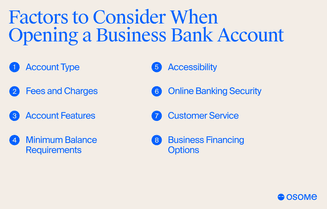

Factors To Consider When Opening a Business Bank Account

There are various factors to consider regarding business accounts, including who you bank with. Begin by assessing the bank’s reputation and reliability. As a business owner, you want to ensure your business accounts are safe. Selecting a well-established and secure bank that provides competitive banking services, including merchant services, payroll management, and integration with accounting software, is vital. Here are the main factors that you need to pay attention to:

- Minimum monthly balance

- Minimum initial deposit

- Mobile banking options

- Multi-currency options

Aside from the bank’s standing, the cost and features of the business account play a significant role. Analyse the rates and fees attached to the business account, including:

- monthly maintenance fees (monthly account fees)

- transaction fees

- ATM fees

- fall-below fees

- wire transfer fees

This will help you understand the total cost of banking services. Another consideration is the minimum monthly balance requirements of various business accounts. This can help you avoid additional charges and ensure compatibility with your business’s liquidity. Inquire about the borrowing costs and how they are compounded (daily, monthly, or annually) for the relevant business accounts.

By the way, Osome has partnered with Aspire, one of the best digital payment services for entrepreneurs in Singapore, and can help you open a business bank account on good terms.

Subsequently, take into account the array of services the bank offers when considering a corporate bank account. Look for banks that provide tools for better bookkeeping, cash flow management, and collaboration with accounting software.

The 6 Best Business Bank Accounts in Singapore

Having covered the essential factors to consider when selecting a business bank account, we can now examine the top six business bank accounts in Singapore. These accounts cater to a variety of business needs and preferences, offering unique features that can help streamline your financial operations and support your business growth.

1 OCBC Business Growth Account

The OCBC Business Growth Account is among the top contenders. Designed specifically for start-ups or new businesses in Singapore, this account allows instant online account opening and offers benefits such as free unlimited FAST/GIRO transactions for bulk payments and payroll transactions. Businesses using this account can enjoy up to 1% cashback on debit card transactions, making it a great choice for growing businesses.

This account provides a cost-effective start for new businesses, as the charges are waived for the first two months for new customers, allowing for free transactions during this period.

The process of opening an OCBC Business Growth Account is quite simple. Businesses can apply online through the OCBC portal, which can be authenticated using Singpass for non-OCBC personal banking customers. So you do not need to visit a bank branch. However, an early closure fee of S$ 50 is applied to accounts closed within 12 months of opening, so it’s best suited for businesses with long-term plans.

Feature | Description |

|---|---|

| Initial deposit amount | S$ 1,000 |

| Minimum monthly balance (fall-below fee) | S$ 15 per month if monthly average balance falls below S$ 1,000. |

| Monthly account fee | S$ 10 per month. Waived for the first 2 months. |

| Online banking features | Internet and mobile banking for effective account management with OCBC Velocity, digital tokens, eAlerts, cashflow tools, e-invoicing without any charges. |

| Multi-currency features | Additional OCBC Multi-Currency Business Account for foreign currencies (with S$ 120 annual fee) if you also have an OCBC Business Growth Account opened. S$ 10 per month is chargeable if you no longer have an OCBC Business Growth Account. |

| Cheque book options | S$ 25 per cheque book. Cheque-clearing fee: S$ 3 per cheque. |

2 Airwallex Business Account

Airwallex is a strong contender for businesses operating internationally, especially ecommerce companies, startups, and SMEs looking for low-cost cross-border transactions. This virtual business account allows users to hold and manage funds in multiple currencies, make local payments in over 30 countries, and convert currencies at competitive rates. Airwallex integrates seamlessly with platforms like Xero and offers APIs for customised workflows, making it a smart choice for tech-driven businesses. While it doesn’t offer traditional banking features like cheque books, its digital-first approach is ideal for modern companies looking to streamline their global finances.

Feature | Description |

|---|---|

| Initial deposit amount | No initial deposit is required. |

| Minimum monthly balance (fall-below fee) | No minimum balance and no fall-below fee. |

| Maintenance fee | No monthly account maintenance fee. |

| Online banking features | No monthly account maintenance fee. |

| Multi-currency features | Hold and manage funds in over 20 currencies, including SGD, USD, EUR, GBP, and more. |

| Cheque book options | Not supported |

Opening a business bank account in Singapore? You’ll need a properly incorporated company first. Using a professional incorporation service ensures your documents are in order, speeding up account approval and helping you access essential financial tools from day one.

3 Aspire Business Account

Next on our list is the Aspire Business Account, which offers the following features:

- 100% online account application process

- Supports 19 currencies for local payouts, catering to businesses with international operations

- Integrates with accounting software

- Offers bulk payment services to help businesses streamline their finance operations

A significant advantage of the Aspire Business Account is its pricing. The account offers free account opening with no monthly fee and a custom plan for businesses with more than 100 employees.

Aspire’s platform includes:

- Expense management tools that can organise and categorise business expenses and manage spending limits

- Client funds with Aspire are held in a trust account with a Tier 1 Singaporean bank, ensuring their security

- Over 15,000 businesses as clients

- Recognition as one of the Top 100 most promising fintech startups globally

Aspire has proven to be a top choice for businesses.

Feature | Description |

|---|---|

| Initial deposit amount | No initial deposit is required. |

| Minimum balance (fall below fee) | No minimum balance and no fall-below fee. |

| Maintenance fee | No fee |

| Online banking features | Internet and mobile banking for online transactions such as transfers, eAlerts, and transaction history. |

| Multi-currency features | A multi-currency account for local and international transactions in 30+ different currencies. |

| Cheque book options | Not supported |

4 CIMB SME Account

Catering to small and medium-sized businesses, the CIMB SME Account provides competitive interest rates, low fees, and a variety of financial products and services. It’s an ideal choice for businesses looking for a bank account that offers more than just basic banking services with no fall-below fee.

One of the key features of the CIMB SME Account is its competitive interest fees. They are designed to help your business grow its funds over time. It also offers low monthly account fees, making it a good choice for SMEs.

In addition to basic banking services, the CIMB SME Account also offers a range of financial products and services. These include business loans, trade financing, and treasury and market services. So, whether you’re looking to grow your business, manage your cash movement, or protect your business against market volatility, the CIMB SME Account has got you covered.

Feature | Description |

|---|---|

| Initial deposit amount | No initial deposit is required. |

| Minimum balance (fall-below fee) | No minimum balance and no fall-below fee. |

| Maintenance fee | S$ 0 per month. Waived for the first 12 months. |

| Digital banking features | Online banking platform BizChannel@CIMB with free PayNow/FAST/GIRO payroll transactions and E-Alerts. |

| Multi-currency features | SGD only |

| Cheque book options | S$ 25 per cheque book. No cheque-clearing fee |

5 UOB eBusiness Account

Another excellent choice is the UOB eBusiness Account, which is particularly appreciated for its broad range of digital banking services. This corporate bank account stands out with its comprehensive digital capabilities, from account opening to managing your balances and executing business transactions.

While the UOB eBusiness Account offers a range of digital features, it’s worth noting that the account opening process can be somewhat complex. It involves several steps, including submitting an online application, providing a business director’s details, and submitting a board resolution.

Another potential drawback of the UOB eBusiness Account is its high maintaining balance requirements. Businesses must maintain a minimum monthly average balance, and a fall-below fee is charged if the balance falls below this amount. So, while the UOB eBusiness Account offers a host of digital banking features, it may not be the best choice for businesses with limited cash flow.

Feature | Description |

|---|---|

| Minimum initial deposit | S$ 1,000 |

| Minimum balance (fall-below fee) | S$ 15 per month if the daily balance falls below S$ 5,000. Waived for first 12 months. |

| Maintenance annual fee | S$ 35 |

| Digital banking features | Internet banking, digital tokens, eAlerts |

| Multi-currency features | SGD only |

| Cheque book options | S$ 25 per cheque book. Cheque-clearing fee: S$ 0.75 per cheque |

6 Maybank FlexiBiz Account

Because of its simplicity and cost-effectiveness, the Maybank FlexiBiz Account is a favoured option among new business owners. This account stands out with its no minimum monthly balance or fee policy, making it an excellent choice for businesses looking to minimise their banking costs.

One of the key features of the Maybank FlexiBiz Account is its range of financial services tailored to SMEs. These services include merchant services, payroll management, and integration with accounting software. Thus, businesses can manage their finances more efficiently and focus on their core operations.

Another advantage of the Maybank FlexiBiz Account is its flexible and user-friendly platform. Businesses can easily manage their account balances, execute business transactions, and access a range of digital banking services.

So, if you’re a new business owner looking for a simple and cost-effective banking solution, the Maybank FlexiBiz Account could be the perfect choice for you.

Feature | Description |

|---|---|

| Minimum initial deposit | S$ 1,000 |

| Minimum balance (fall-below fee) | S$ 10 per month if the average daily balance falls below S$ 1,000. |

| Maintenance fee | No fee |

| Digital banking features | Internet banking for online transactions such as local transfers, eAlerts, and transaction history. Customers who maintain a minimum of S$ 30,000 average daily balance in their Maybank FlexiBiz Account can enjoy rebates of transaction fees for local and overseas transfers by switching to e-payments. |

| Multi-currency options | Available in additional Foreign Currency Current Account. |

| Cheque book options | First 30 cheques free per month, S$ 0.75 per cheque thereafter. |

How Osome Can Help

Osome makes starting and running a business in Singapore seamless by providing expert support at every stage — from company incorporation to ongoing accounting and compliance. Our specialists ensure your business structure and filings meet all ACRA and IRAS requirements, giving you peace of mind and more time to focus on growth.

Once your company is incorporated, Osome offers free assistance with opening a business bank account through our trusted partners such as Aspire, Airwallex, Wise, and UOB. These partners enable digital, remote account opening, ideal for entrepreneurs who cannot be present in Singapore for KYC verification. Please note that this service is exclusively available to Osome clients, and final approval remains at the discretion of the bank.

Summary

In summary, choosing the right business bank account is a critical decision that can significantly impact your business’s financial success. From OCBC Business Growth Account tailored for startups, Airwallex Business Account’s multi-currency feature, Aspire Business Account’s 100% online application, CIMB SME Account’s competitive interest fees, UOB eBusiness Account’s comprehensive digital banking services, to Maybank FlexiBiz Account’s cost-effectiveness, there are numerous options to choose from.